In Bitrix24, you can configure tax rates for products and services. This eliminates manual calculations. Taxes are automatically applied to documents, invoices, and deals. Customers immediately see the total amount including VAT, and employees avoid errors.

Role-based access permissions in CRM

In this article:

- Select a tax type

- Location-dependent tax (sales tax)

- Item-dependent tax (VAT)

- Edit VAT rate

- Edit VAT rate

Select a tax type

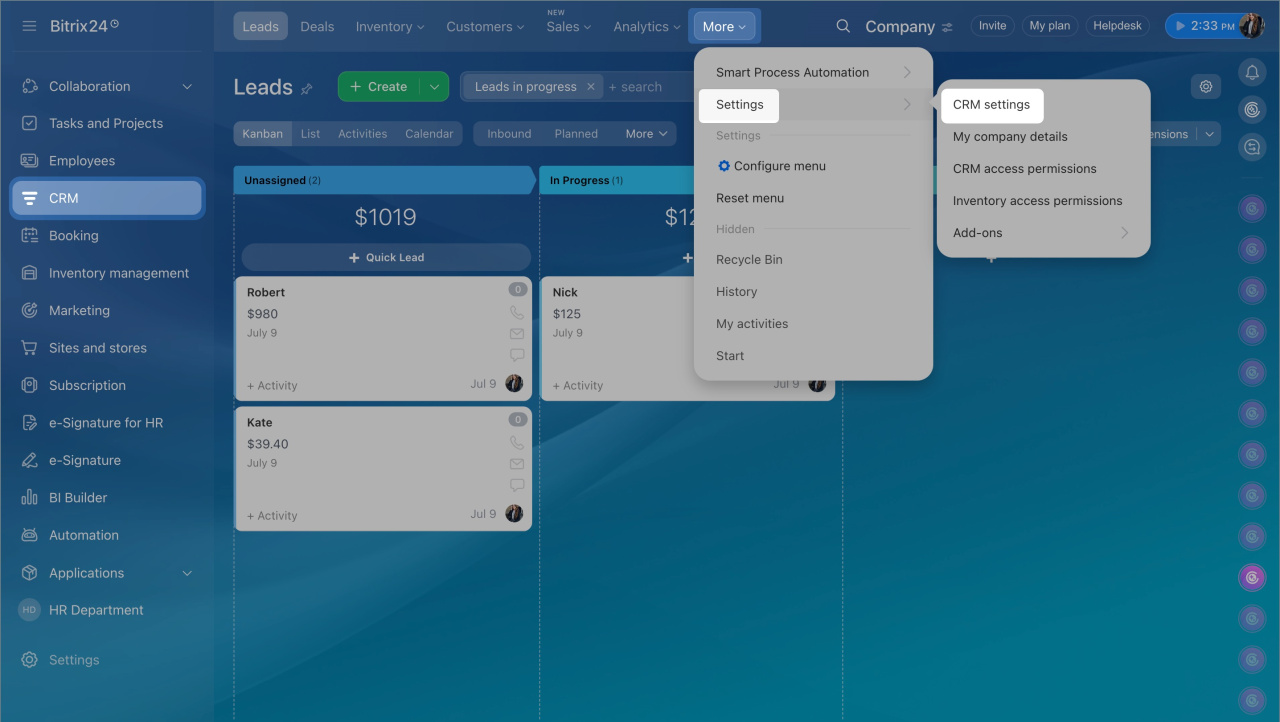

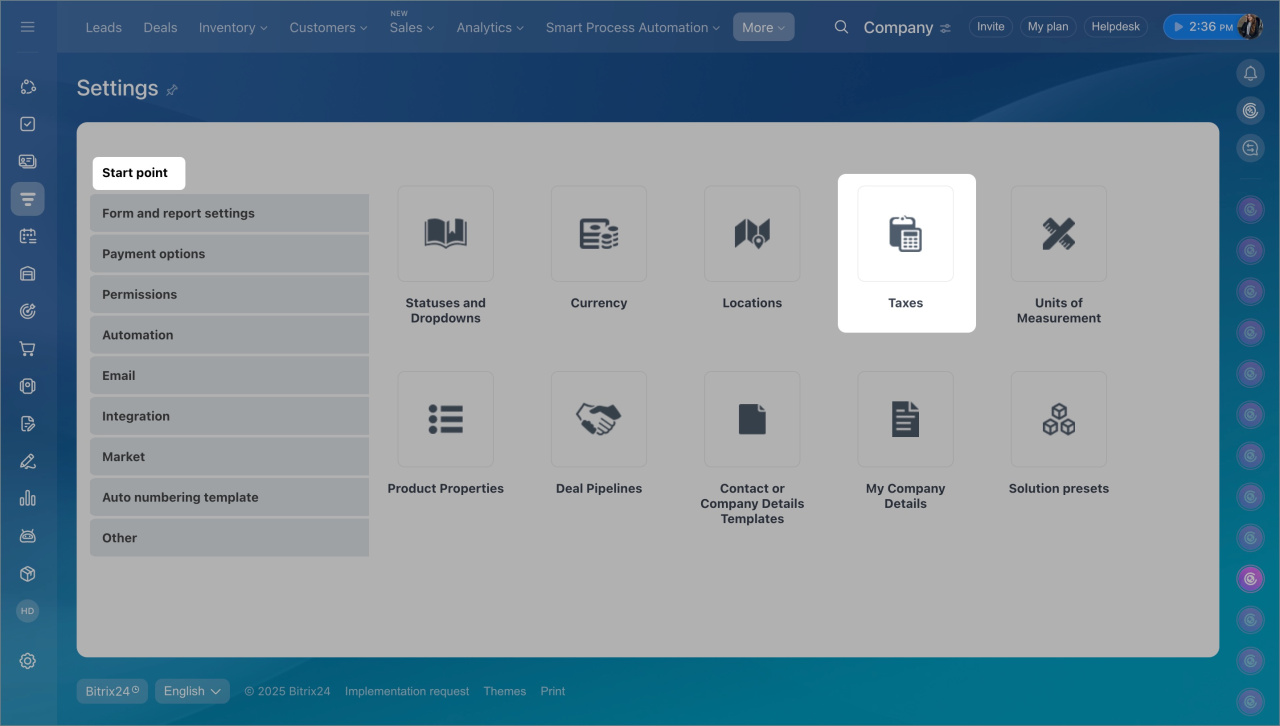

- Go to the CRM section > More > Settings > CRM settings.

- Select Taxes.

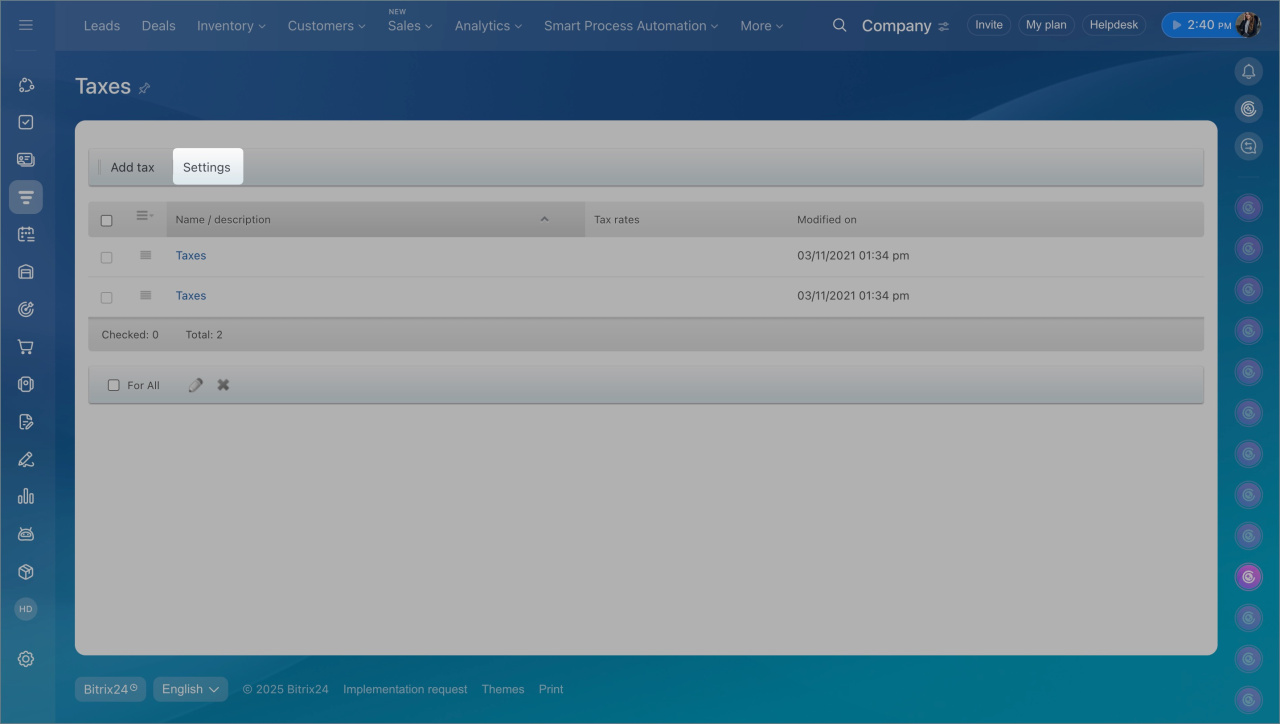

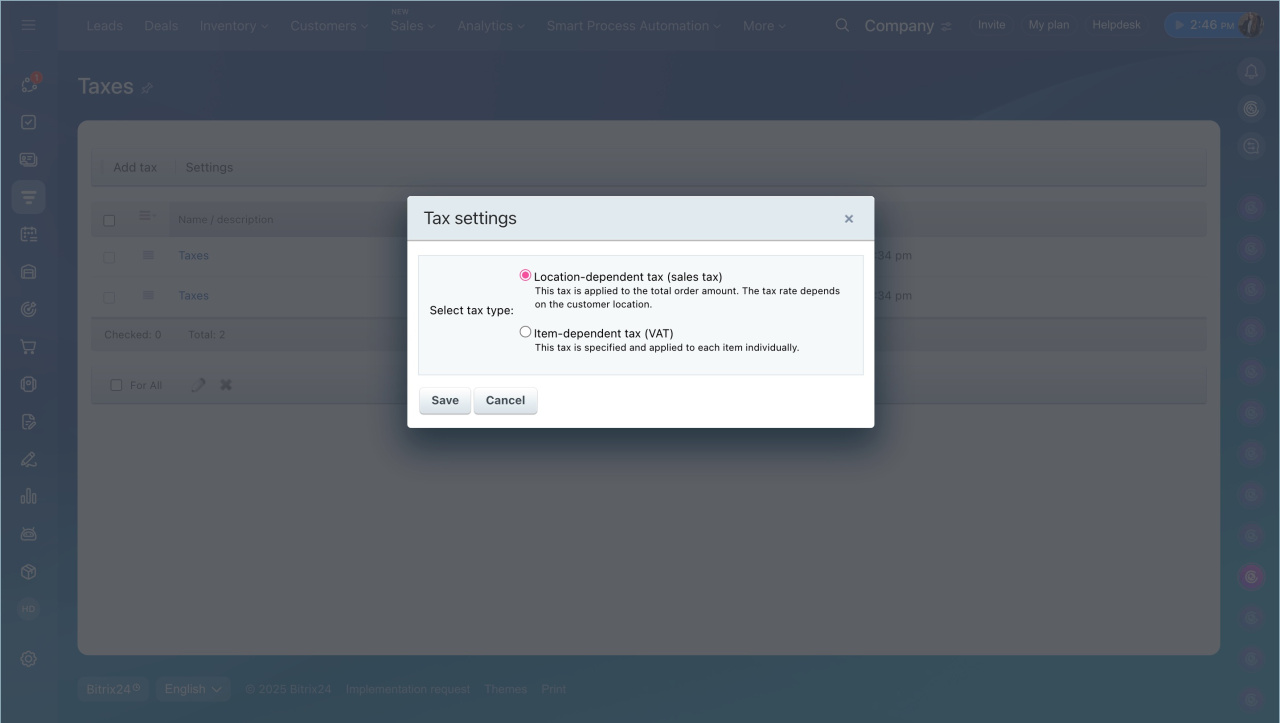

- Click Settings and select a tax type:

- Location-dependent tax (sales tax). This tax is applied to the total order amount. The tax rate depends on the customer location.

- Item-dependent tax (VAT). This tax is specified and applied to each item individually.

Locations

Location-dependent tax (sales tax)

You need to add locations first to use this type of tax.

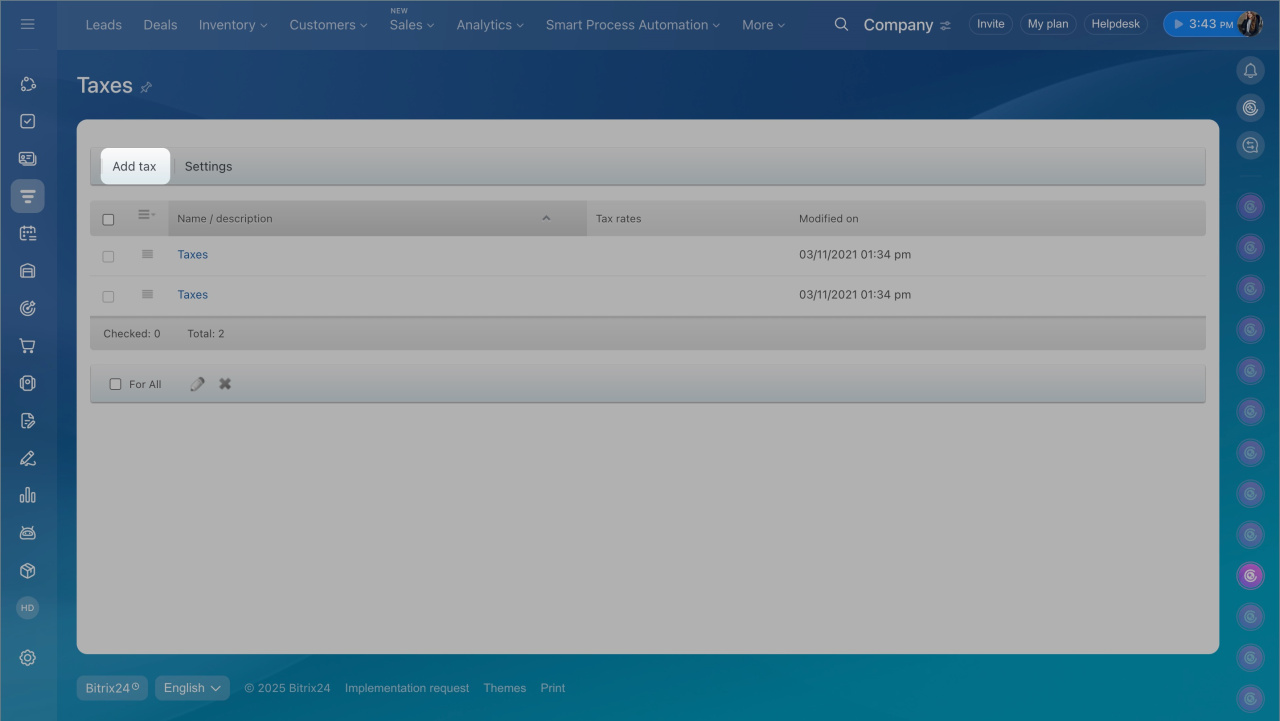

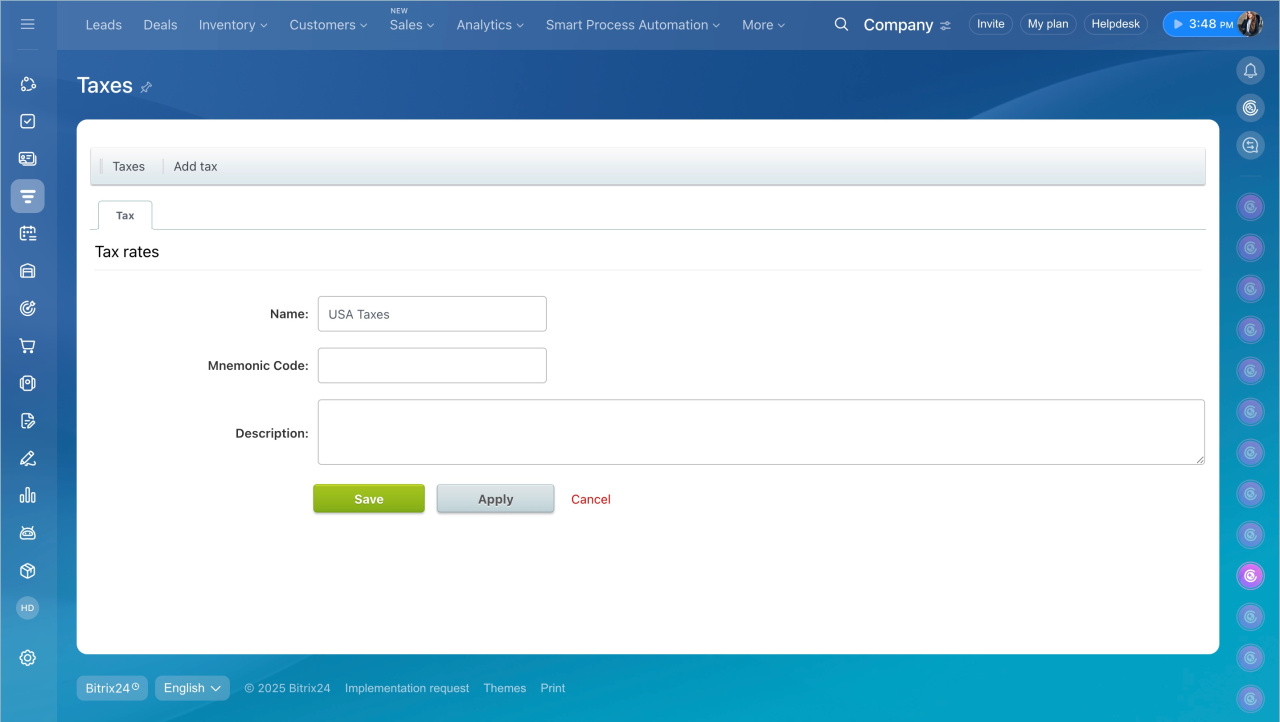

- Open the Taxes section in CRM settings and click Add tax.

- Enter the tax name and description in the special form. Then click Apply.

Configure tax rates

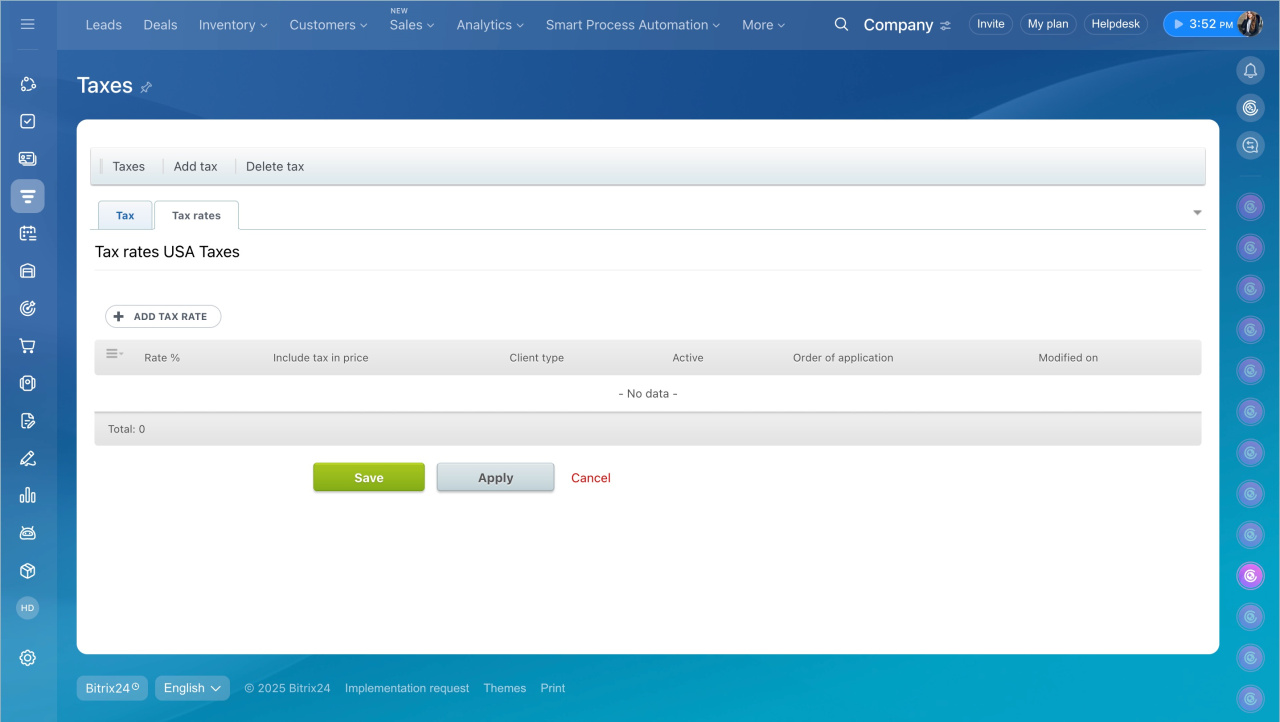

- Switch to the Tax rates tab, and click + Add tax rate.

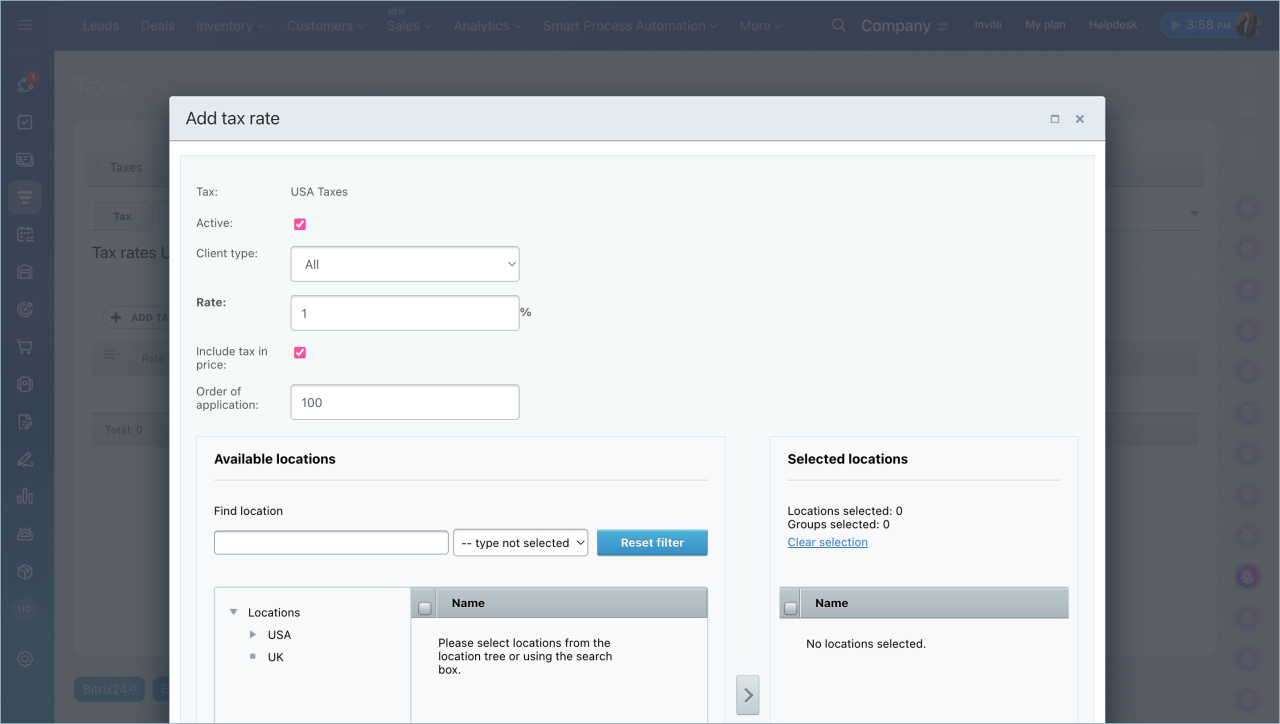

- Specify the tax rate and select the location to which it will be applied.

- Before you save the settings, ensure to make this tax rate Active. In addition, you can enable the Include tax in price option.

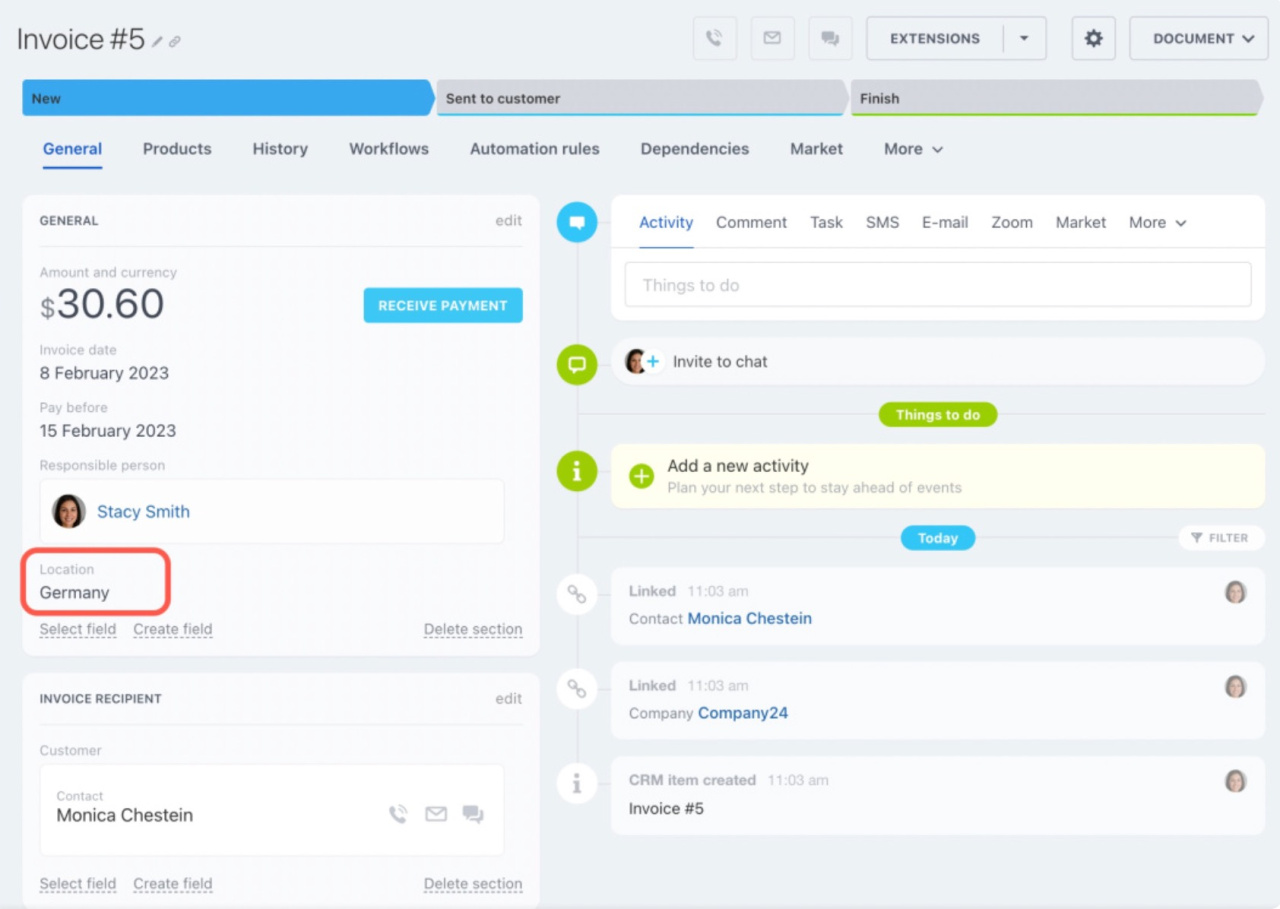

When creating an invoice or estimate, besides providing customer details, you will need to specify the customer's location.

If there is a tax for the specified location, the system will automatically apply it.

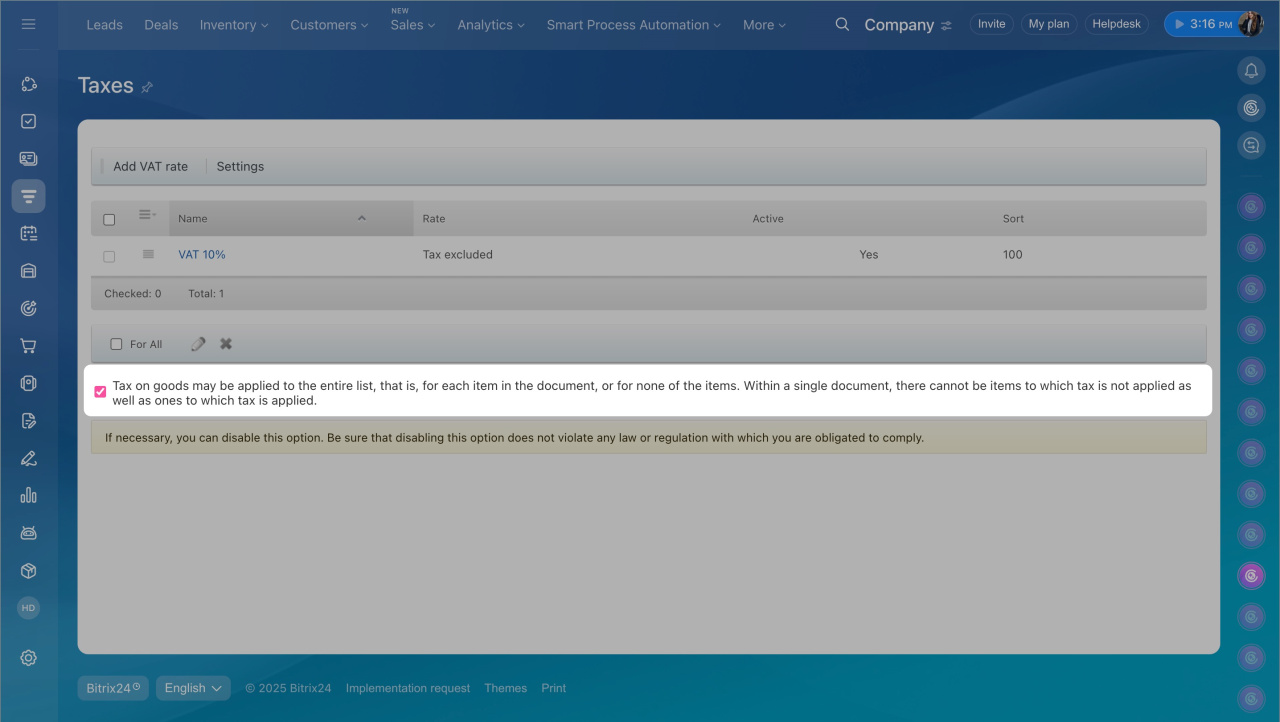

Item-dependent tax (VAT)

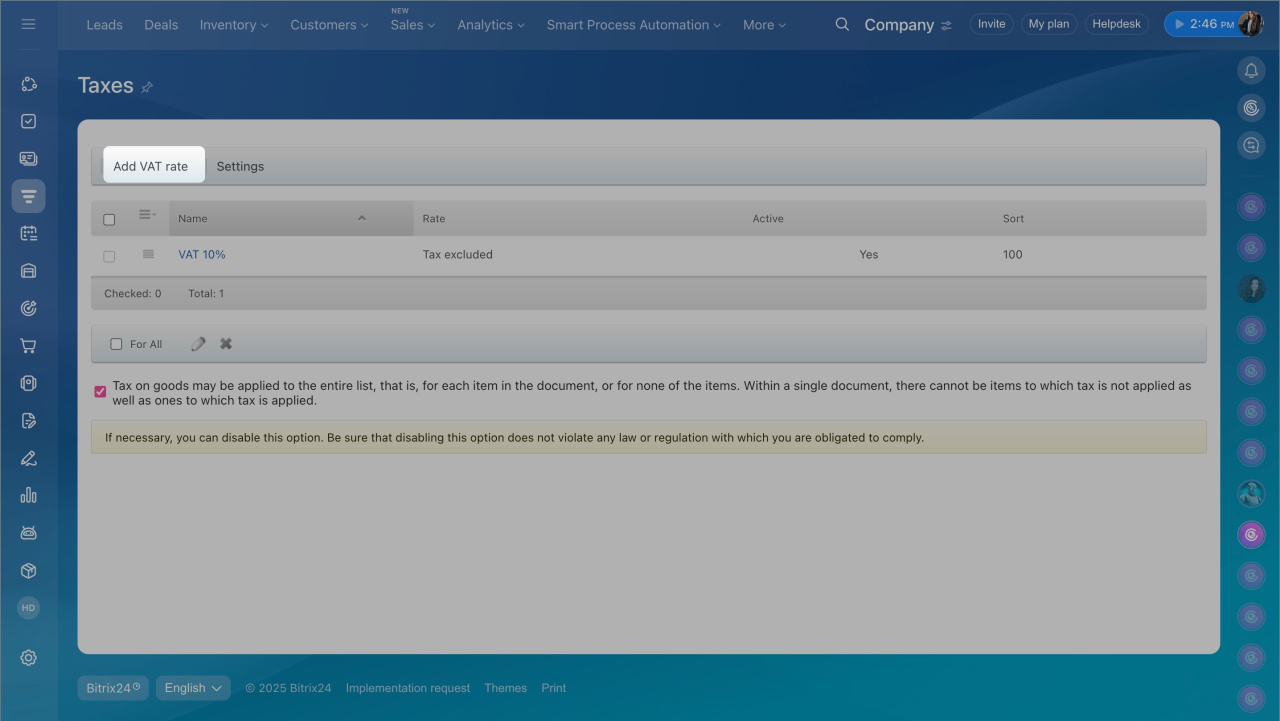

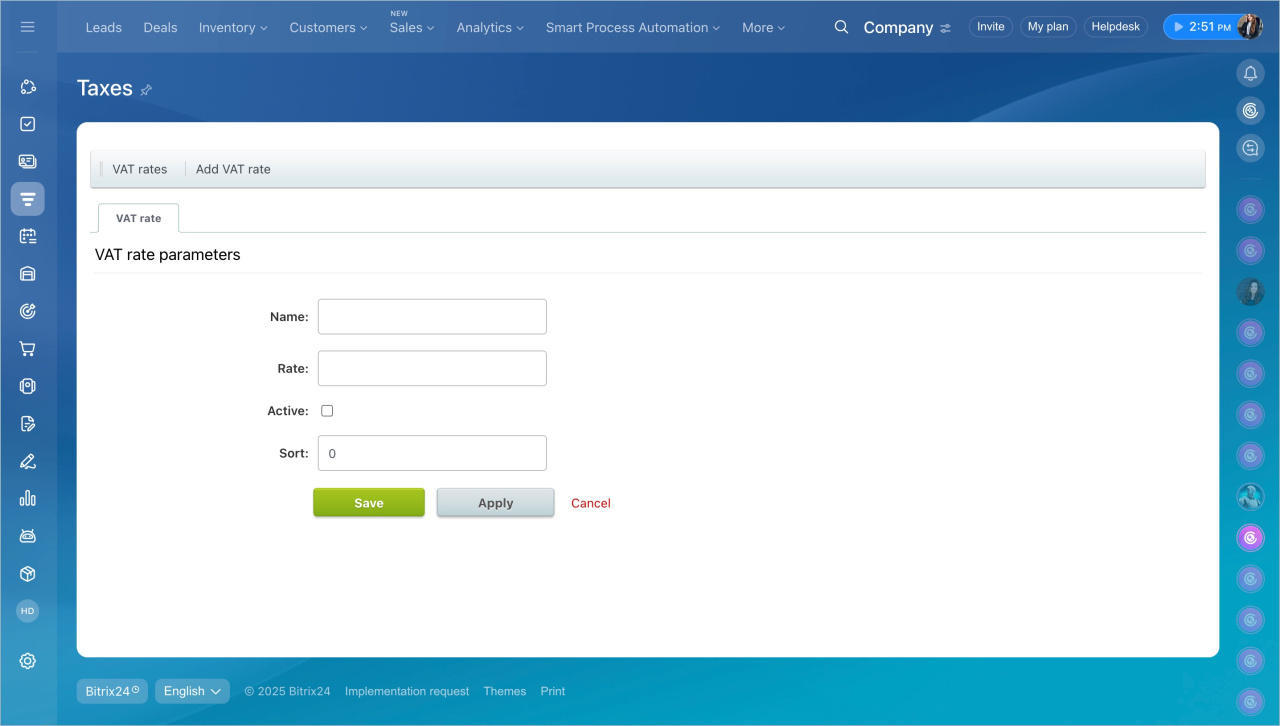

- Click Add VAT rate.

- Configure VAT rate parameters.

- Before you save the settings, ensure to make this tax Active. Then click Save.

Name — for example, VAT 10%.

Rate — enter the tax percentage.

Active — check the box to make the tax available in deals and documents.

You can immediately include the tax in the product price. If the option is disabled, the tax is added on top of the product price. For example, with a 10% rate and a price of $10,000:

- With tax included, $909.09 is already accounted for in the total.

- Without tax, the total product price will be $11,000.

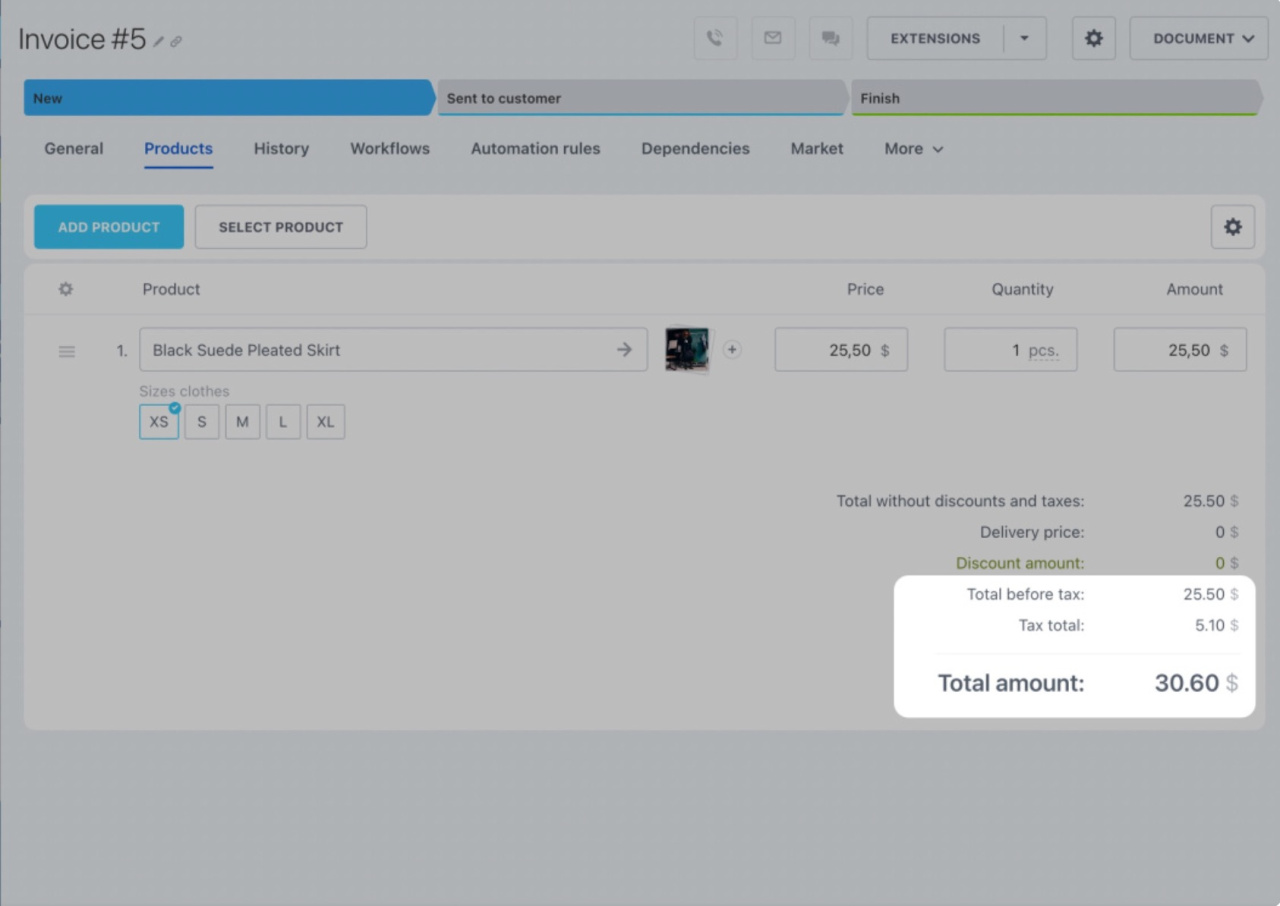

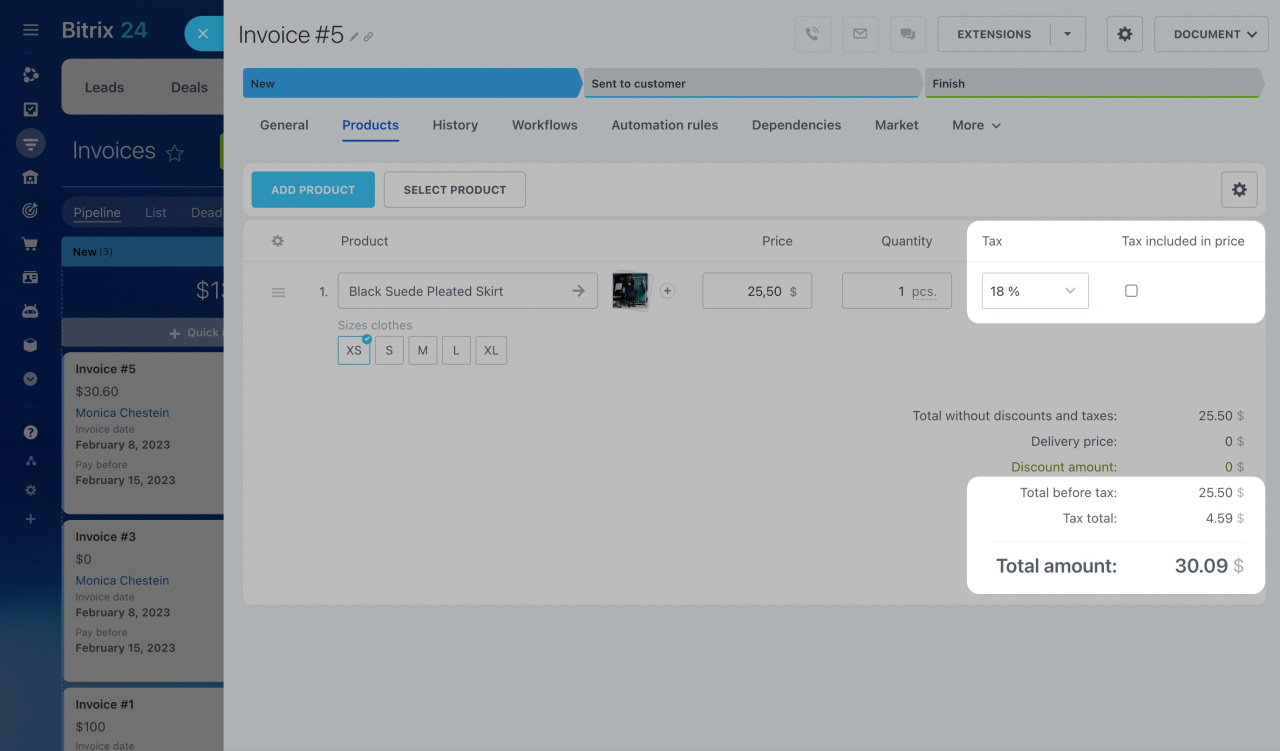

When creating an invoice or estimate, you can choose a VAT rate for each product in the Products tab. Also, you can enable the Tax included in price option.

Edit VAT rate

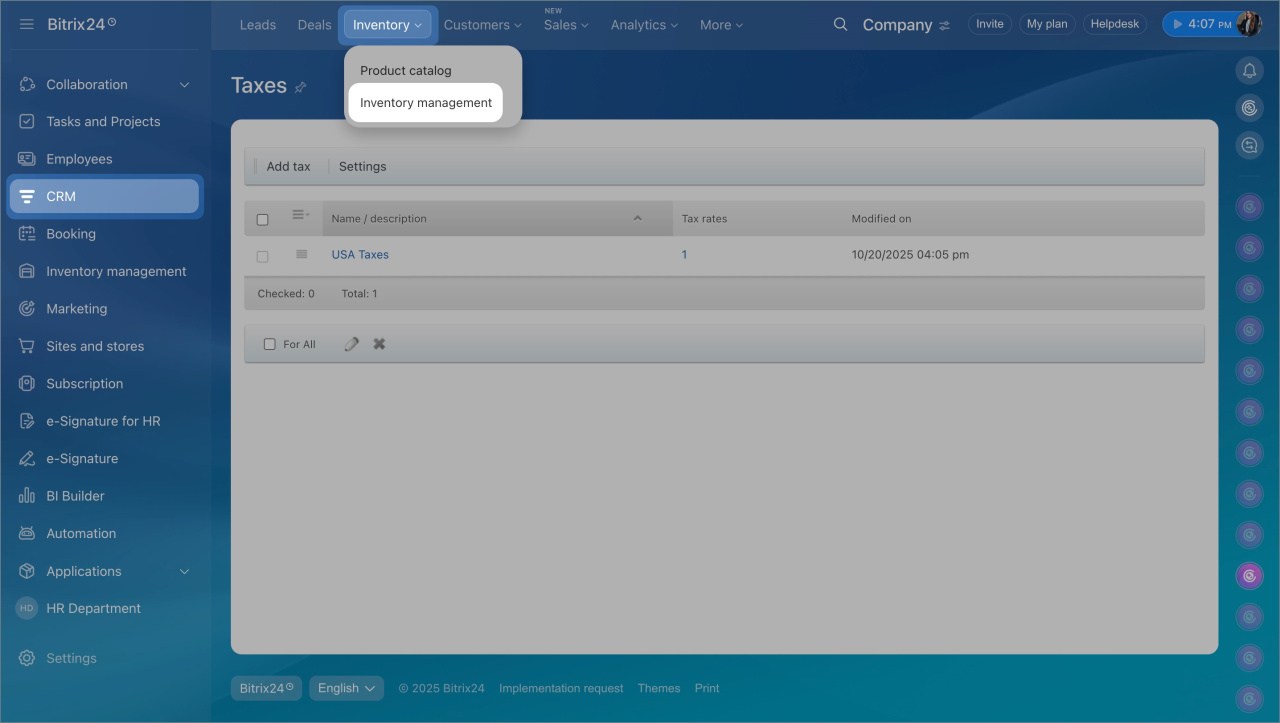

If the VAT for each product tax type is selected, the default rate is 20%. You can change it in the Inventory management settings, the product form, or the deal form.

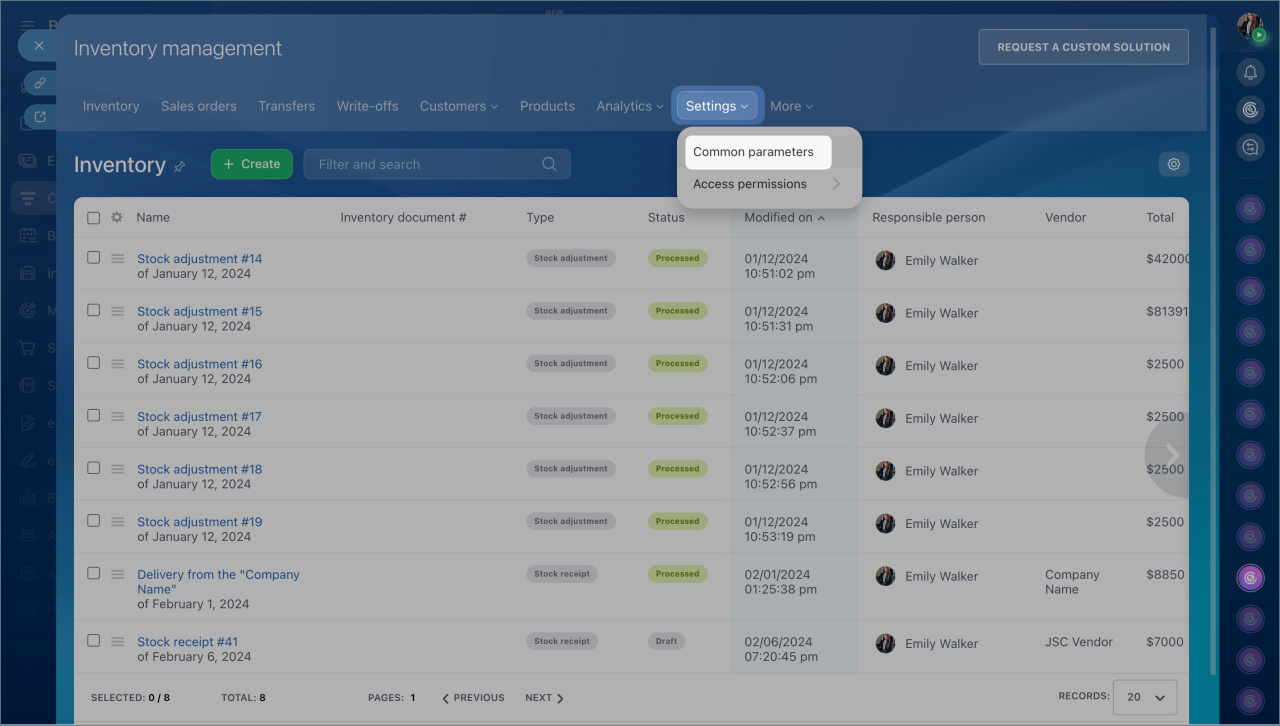

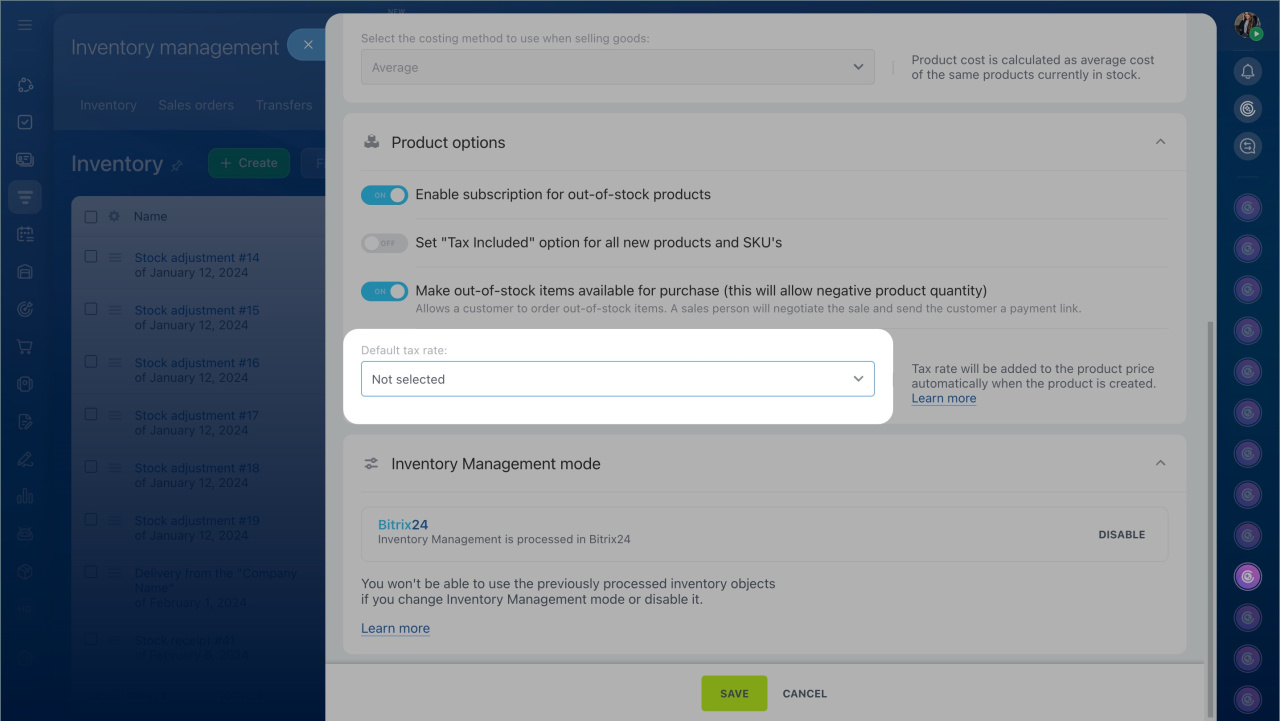

Inventory management settings. It allows you to select a rate that will automatically apply in the product form.

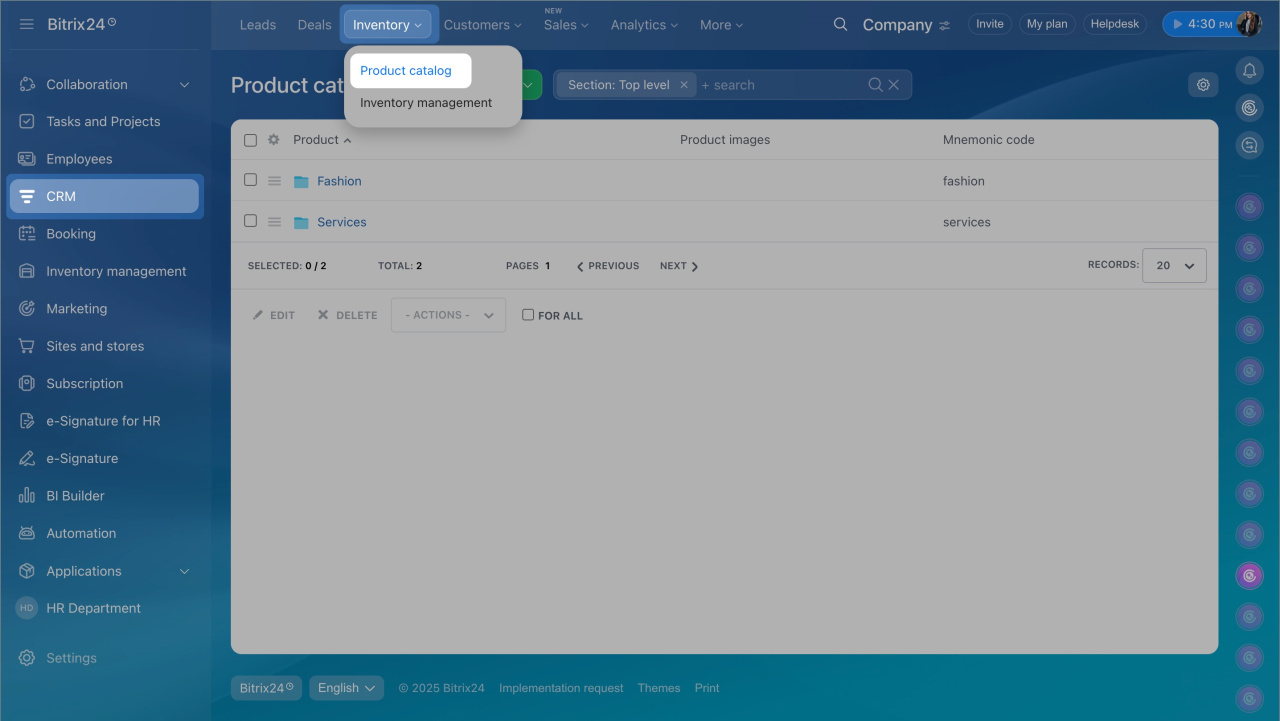

- Go to the CRM section > Inventory > Inventory management.

- Click Settings > Common parameters.

- Scroll the page down to the Product options section and select a rate in the Default tax rate: field.

Inventory management settings

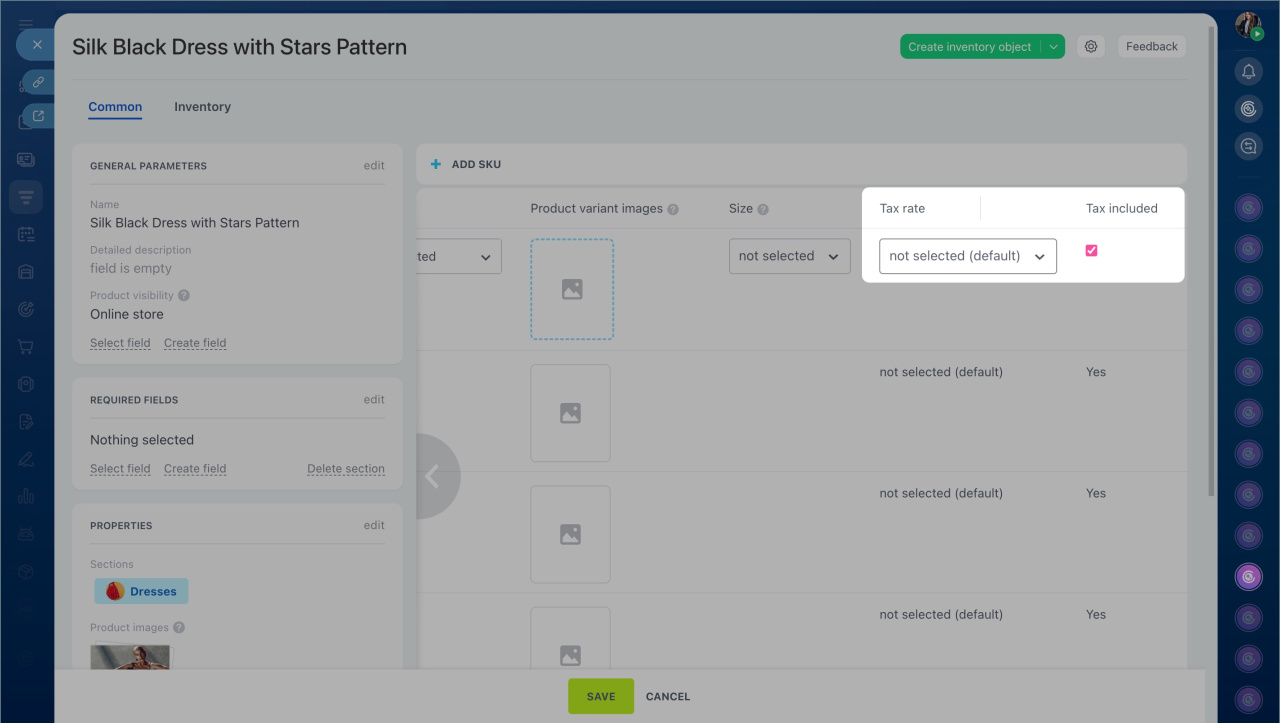

In the product form. You can select a rate in the product form if it differs from the default rate.

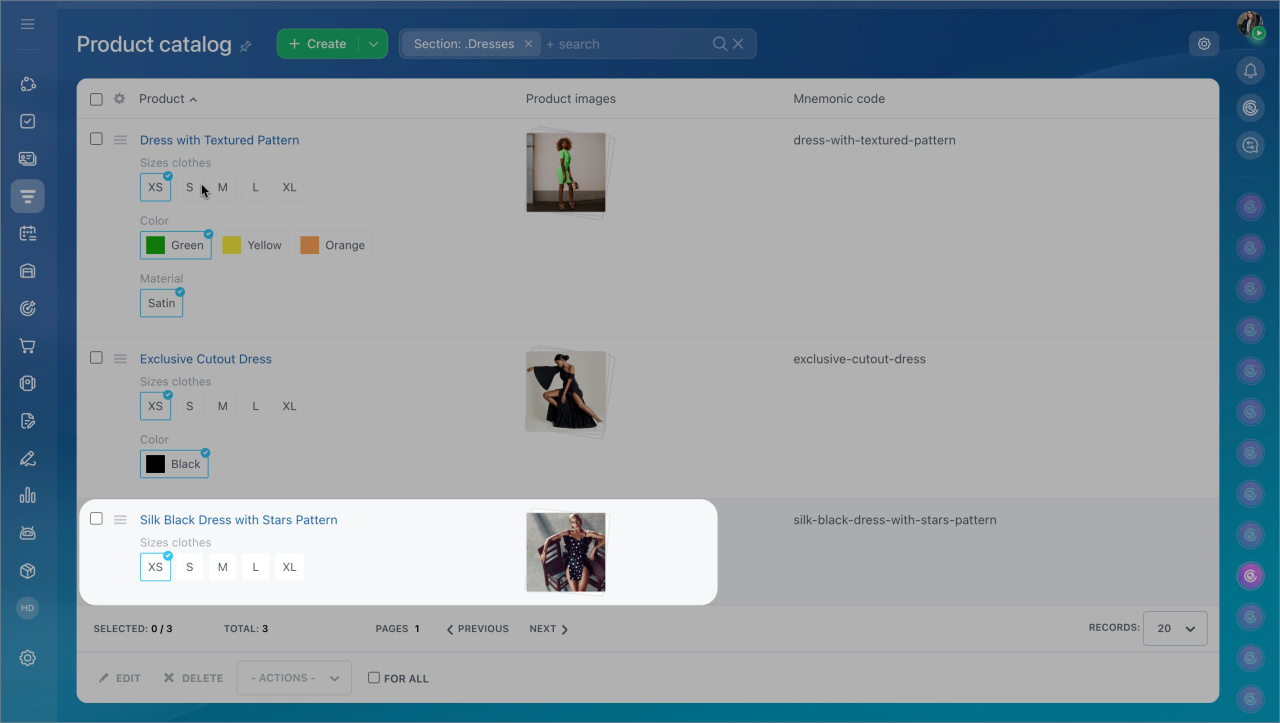

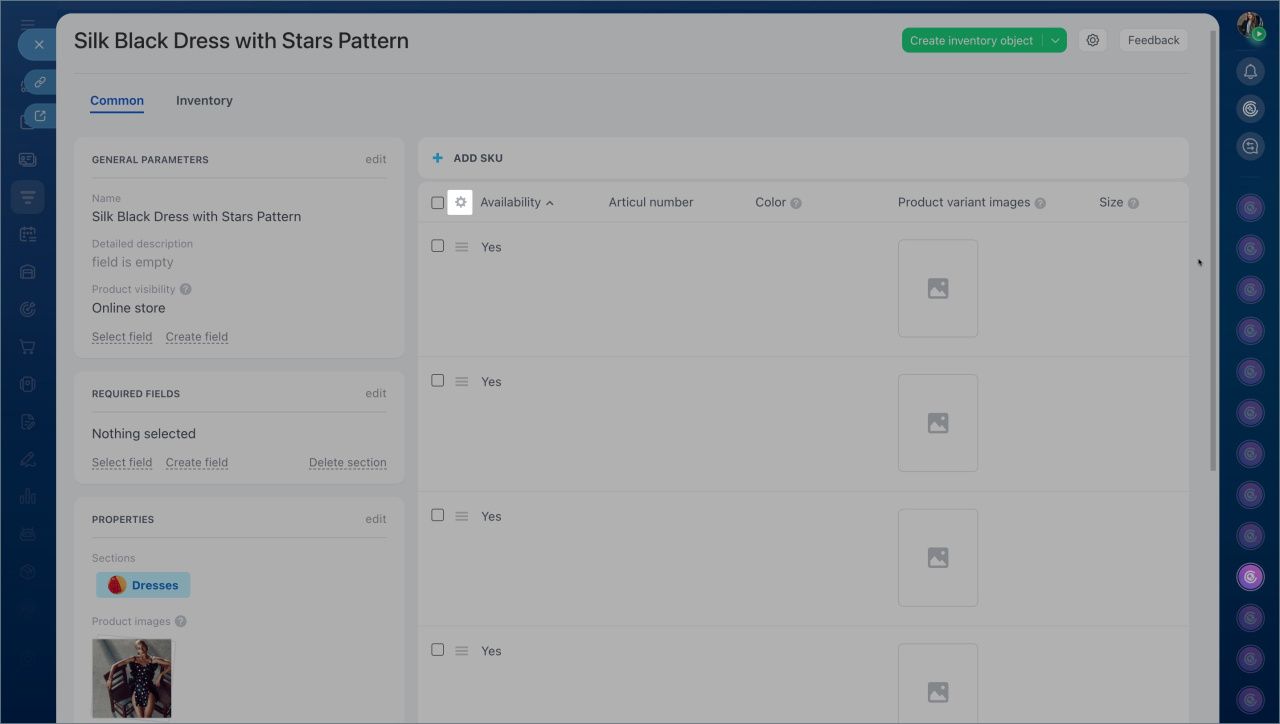

- Go to the CRM > Inventory > Product catalog and open the desired product form.

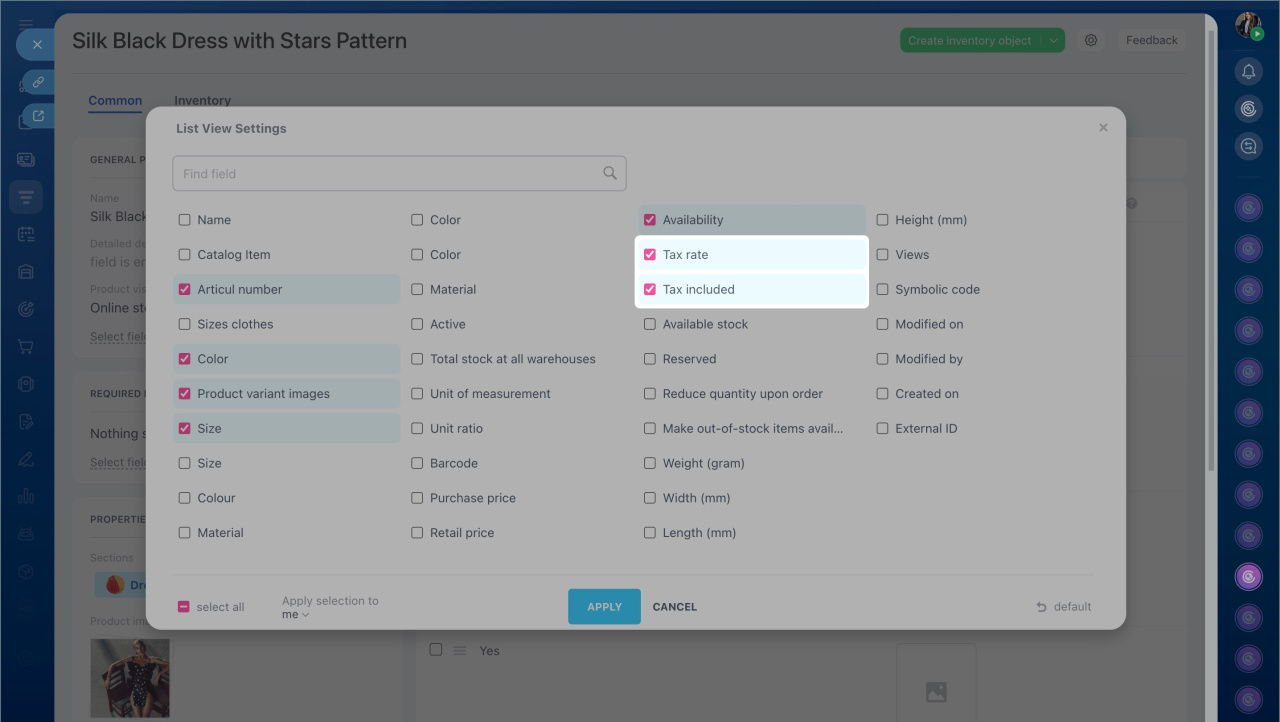

- Click Settings (⚙️).

- Add the VAT rate and VAT included in price fields and click Apply.

- Select the product tax rate in the VAT rate column. Check the VAT included in price box to include the tax in the product price.

- Save the changes.

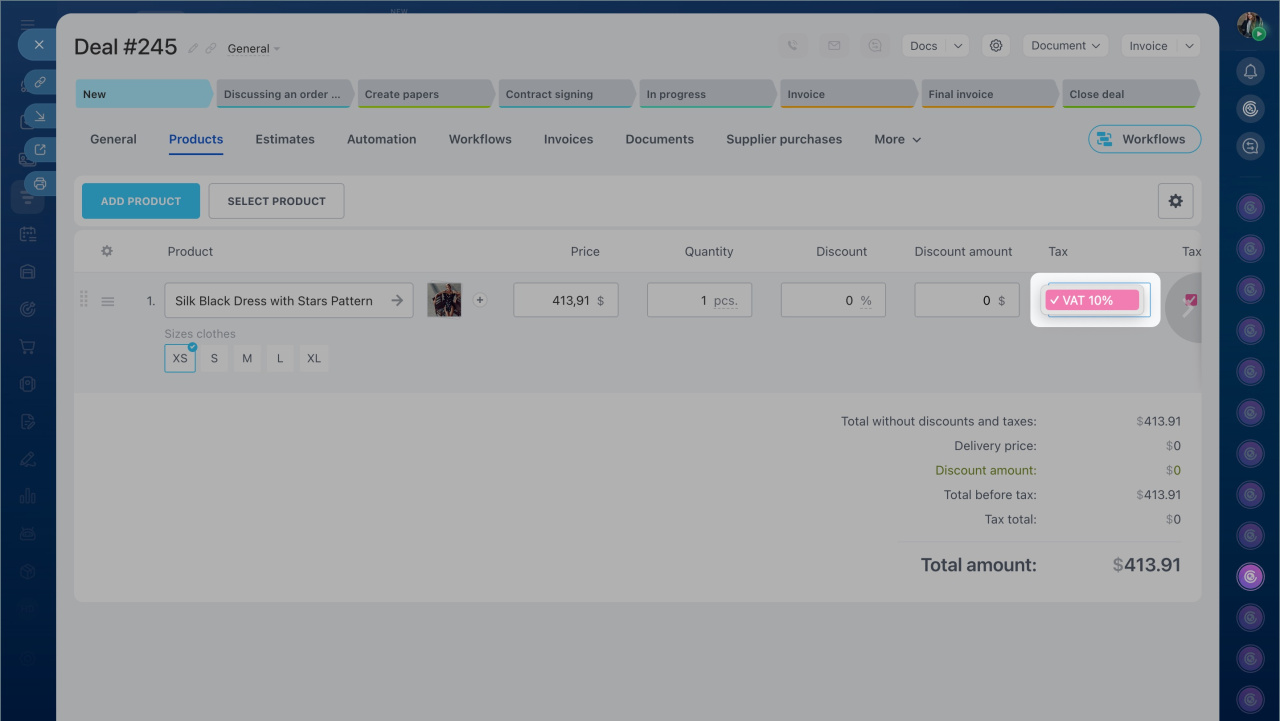

In the deal form. The deal displays the default rate or the one selected in the specific product form. You can change it if needed.

- Go to the Products tab.

- Specify the desired VAT rate for each item.

- The totals with and without tax will automatically appear at the bottom of the table.

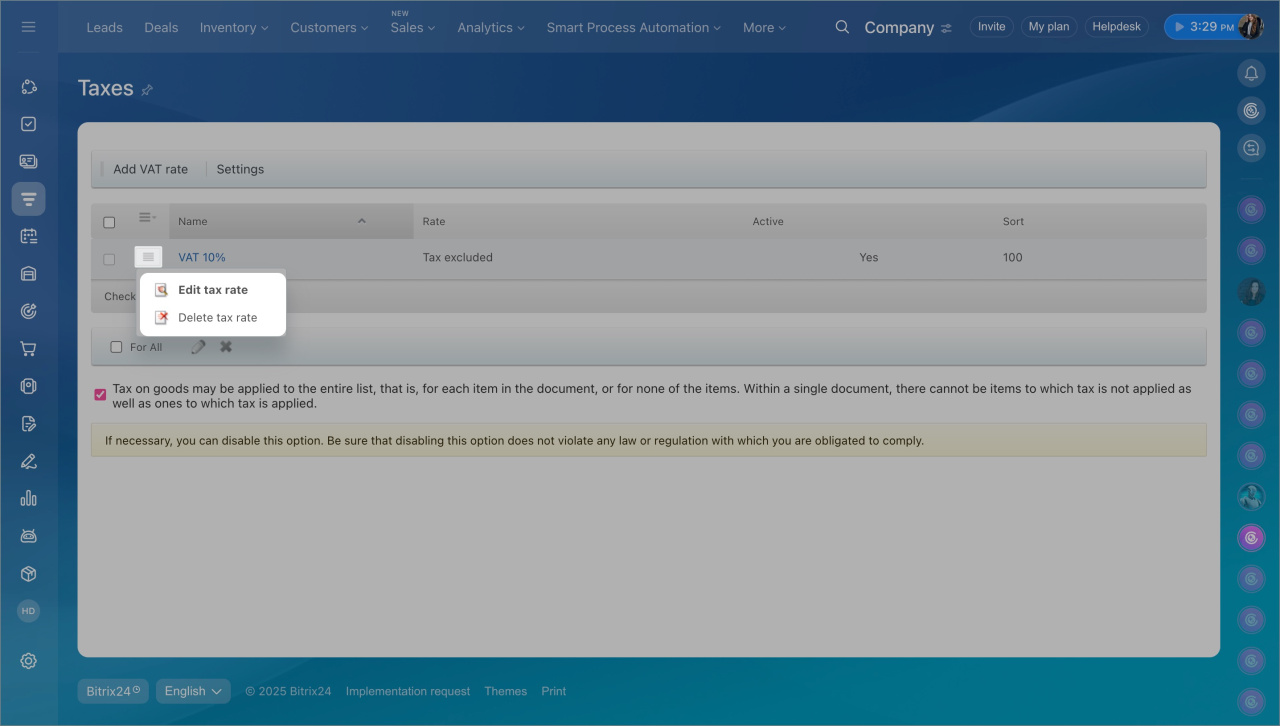

Edit or delete a tax rate

Click Menu (≡) next to the desired rate and select Edit VAT rate. You can change the name, tax rate, and activity. To delete a rate, select Delete VAT rate.

In brief

- In Bitrix24, you can configure tax rates for products and services. Taxes are automatically applied to documents, invoices, and deals.

- CRM offers two types of taxes: location-dependent tax (sales tax) and Item-dependent tax (VAT).

- To select a tax type, go to the CRM section > More > Settings > CRM settings > Taxes.

- After selecting a tax type, add a tax rate. By default, VAT for products is 20%, and the tax on the total document amount depends on the Location field in the deal.

- VAT for products can be configured in the inventory management section, product form, and deal form.

- To edit or delete a tax rate, click Menu (≡) next to the desired rate and select the required action.