Tax is a mandatory payment levied in almost every country of the world. Tax rates may differ depending on the type of taxation, the region of the goods and services, etc. In Bitrix24, you can set any tax rate and decide on your own whether to include it in a product price or not.

Selecting a tax type

You can choose between two types of taxes in Bitrix24 CRM:

-

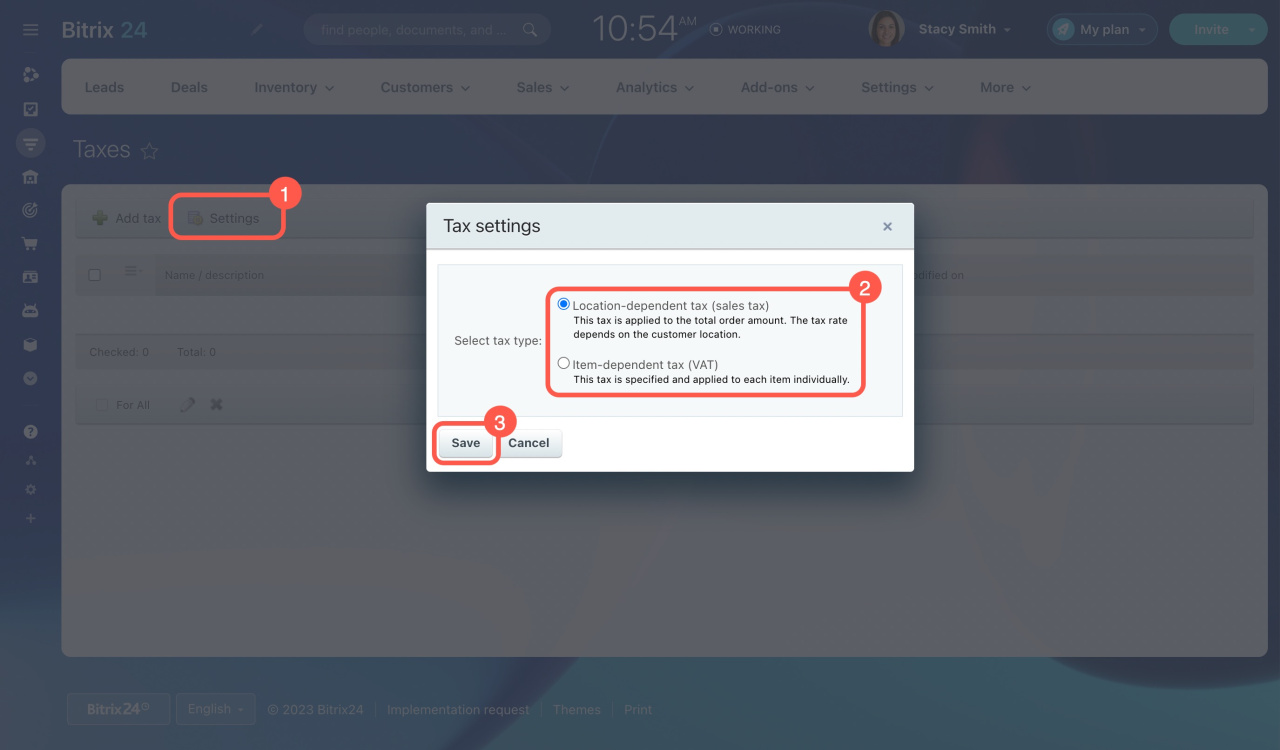

Location-dependent tax (sales tax)

This tax is applied to the total order amount. The tax rate depends on the customer location. -

Item-dependent tax (VAT)

This tax is specified and applied to each item individually.

To set the desired tax type in CRM,

-

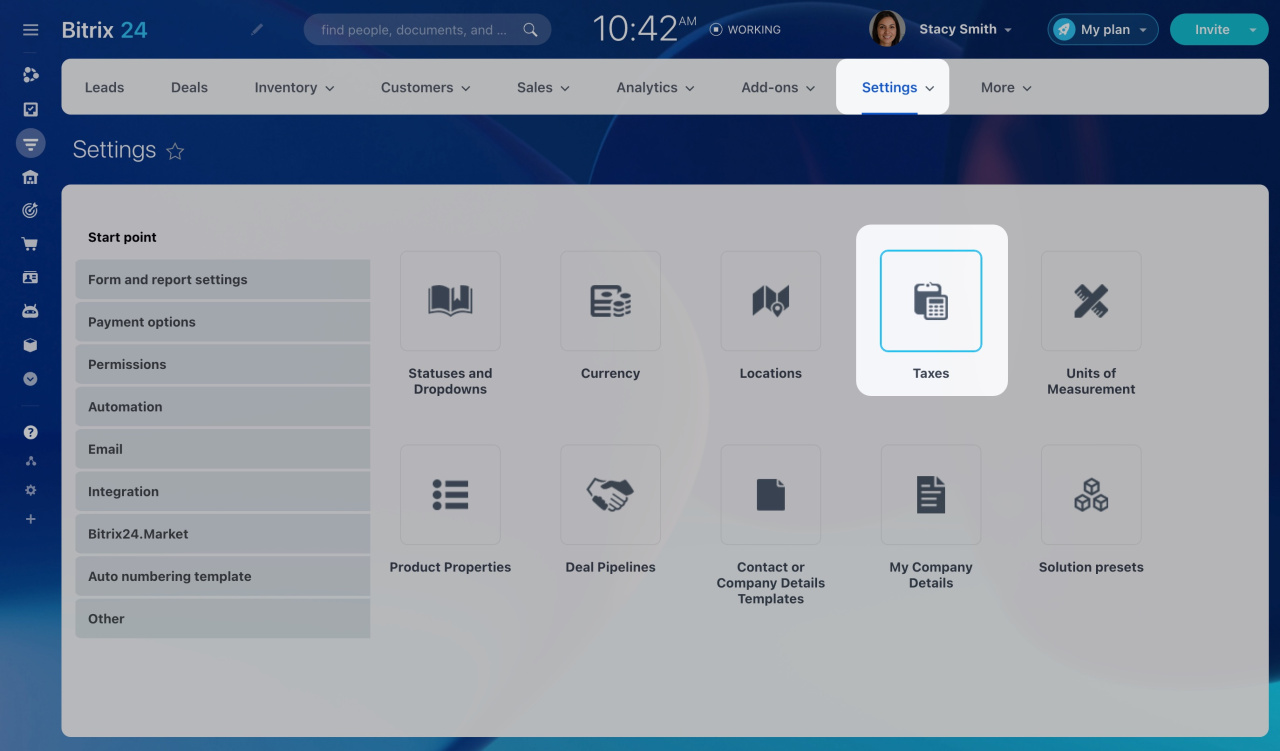

Go to CRM > Settings > CRM settings.

-

Under the Start point tab, select Taxes.

-

Click the Settings button, decide which type of tax you want to use, and click Save.

After that, you can proceed with the steps, depending on the chosen tax type.

Using location-dependent tax (sales tax)

To add a sales tax,

-

You need to add locations first to use this type of tax.

Learn how to add locations in Bitrix24 -

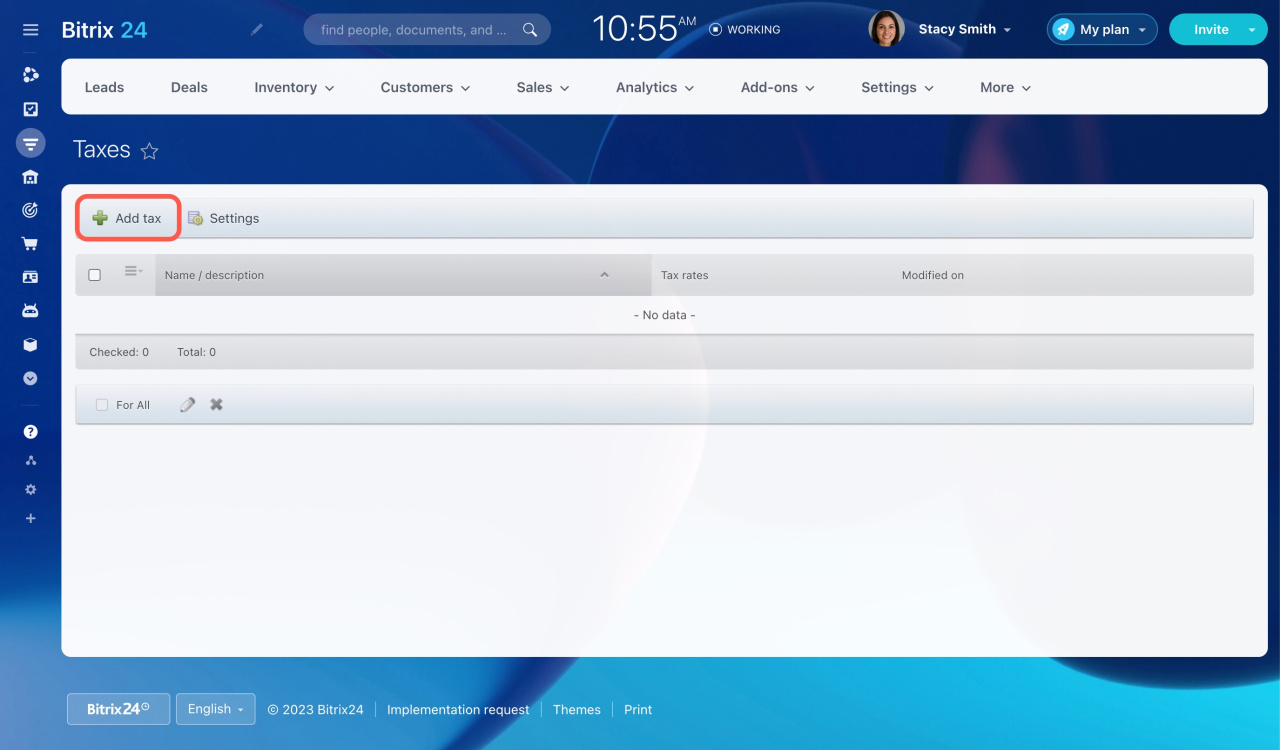

Open the Taxes section in CRM settings and click Add tax.

-

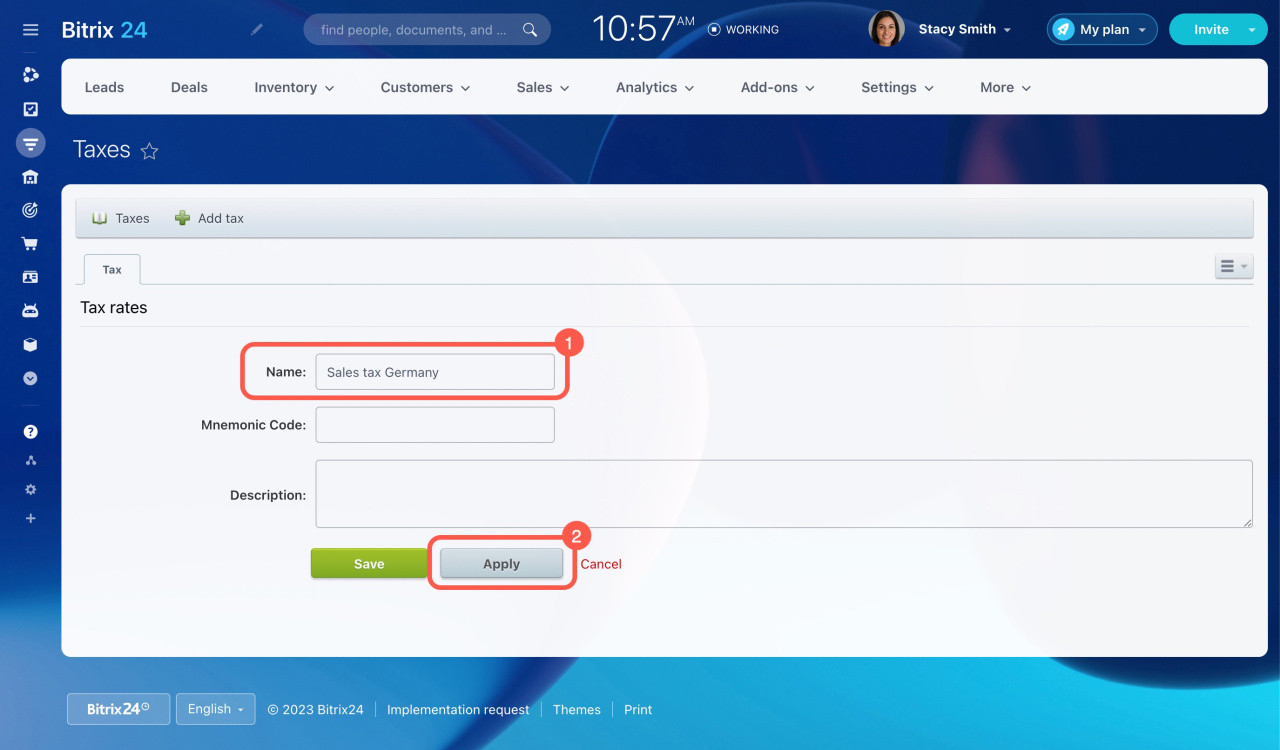

Enter the tax name and description in the special form. Then click Apply.

To configure tax rates for the sales tax,

-

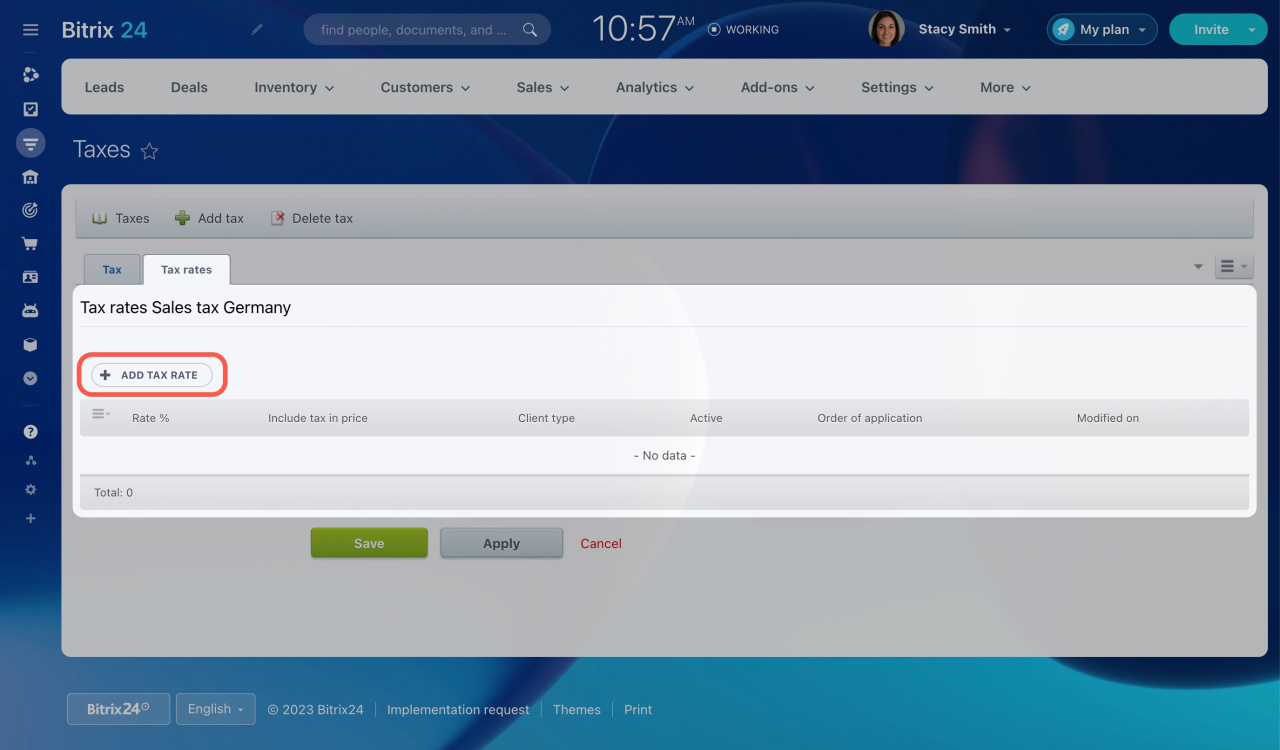

Switch to the Tax rates tab, and click + Add tax rate.

-

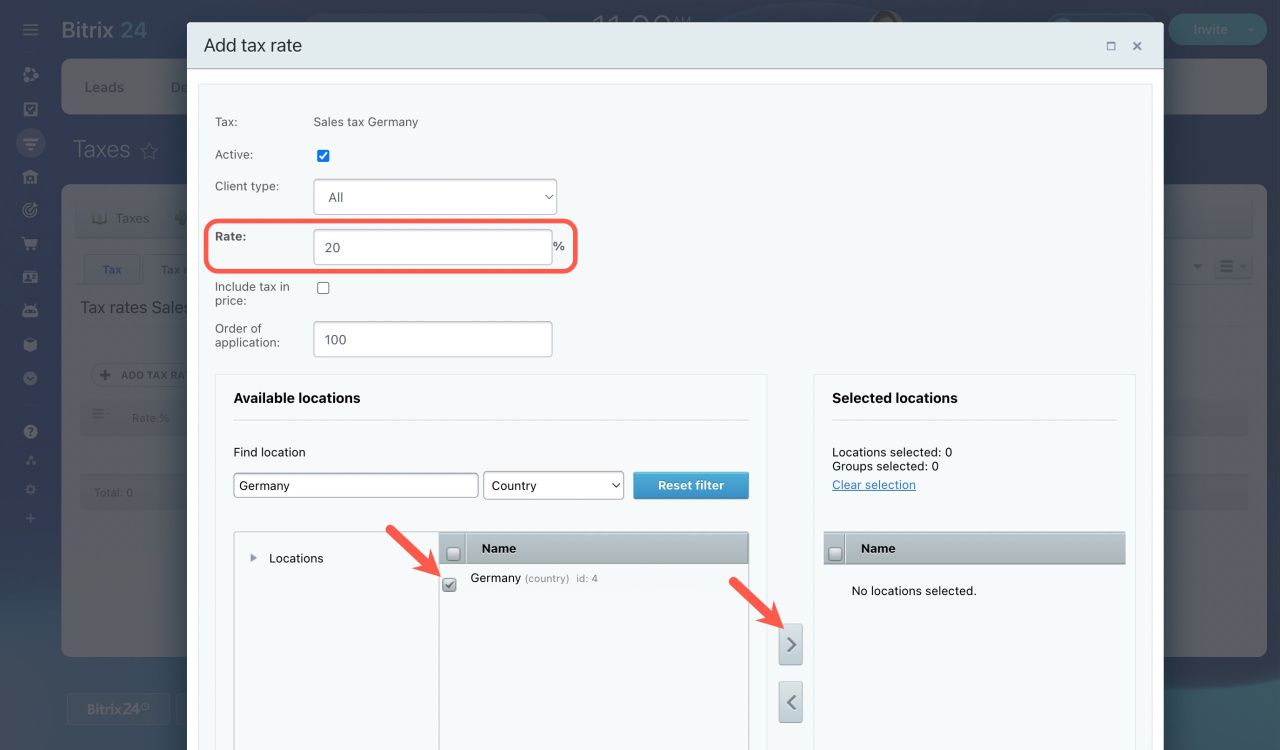

Specify the tax rate and select the location to which it will be applied.

-

Before you save the settings, ensure to make this tax rate Active. In addition, you can enable the Include tax in price option.

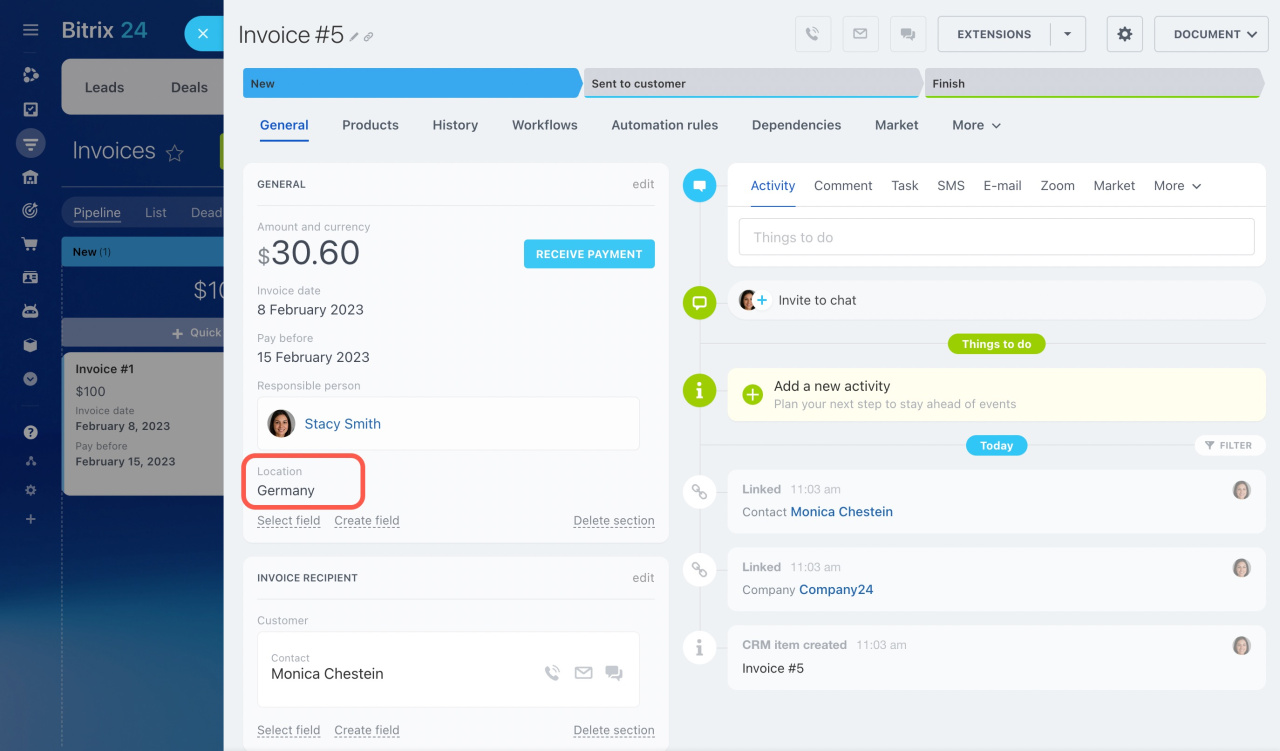

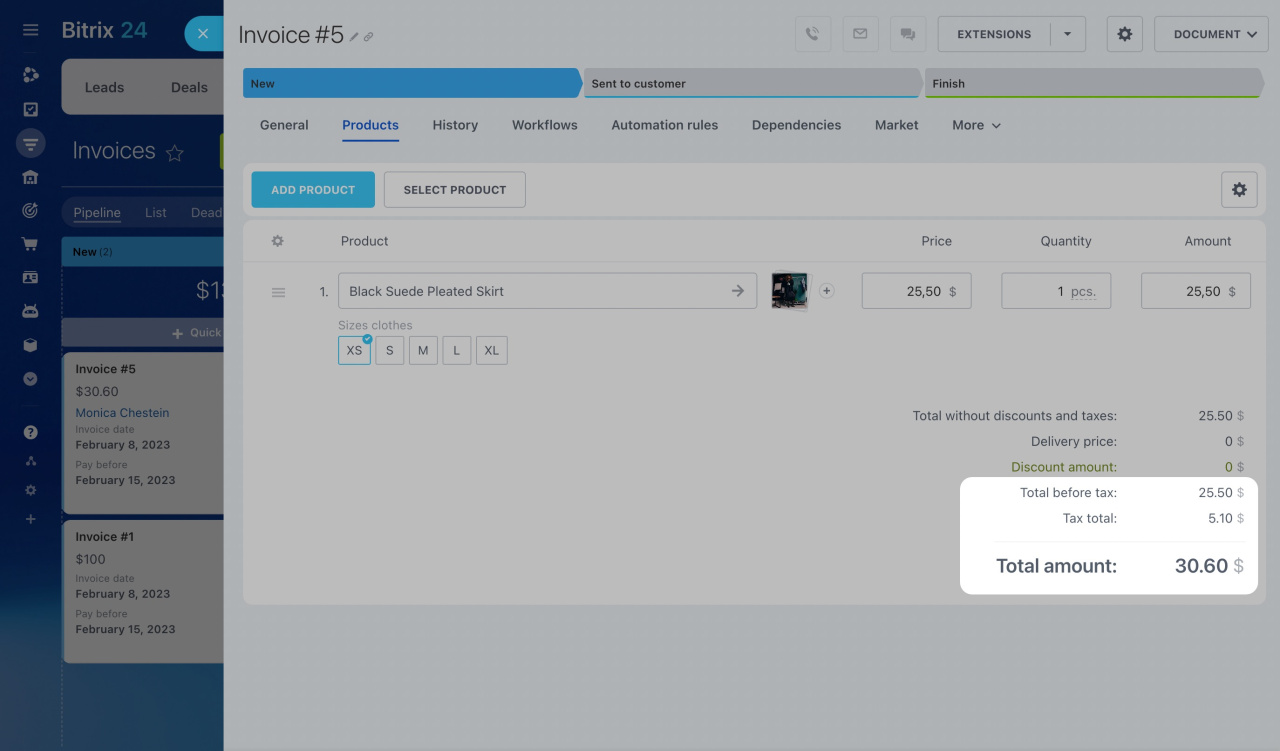

When creating an invoice or estimate, besides providing customer details, you will need to specify the customer's location.

If there is a tax for the specified location, Bitrix24 will automatically apply it.

Using item-dependent tax (VAT)

To add a VAT rate,

-

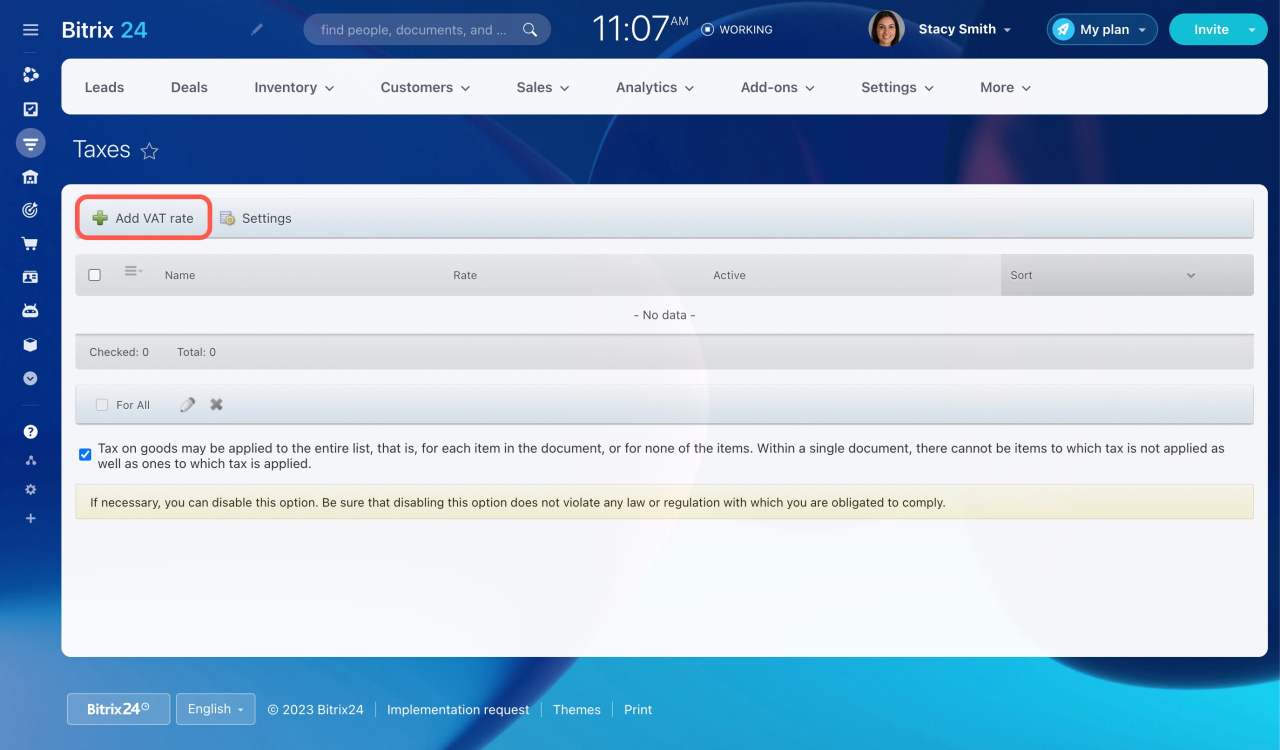

Open the Taxes section in CRM settings and click Add VAT rate.

-

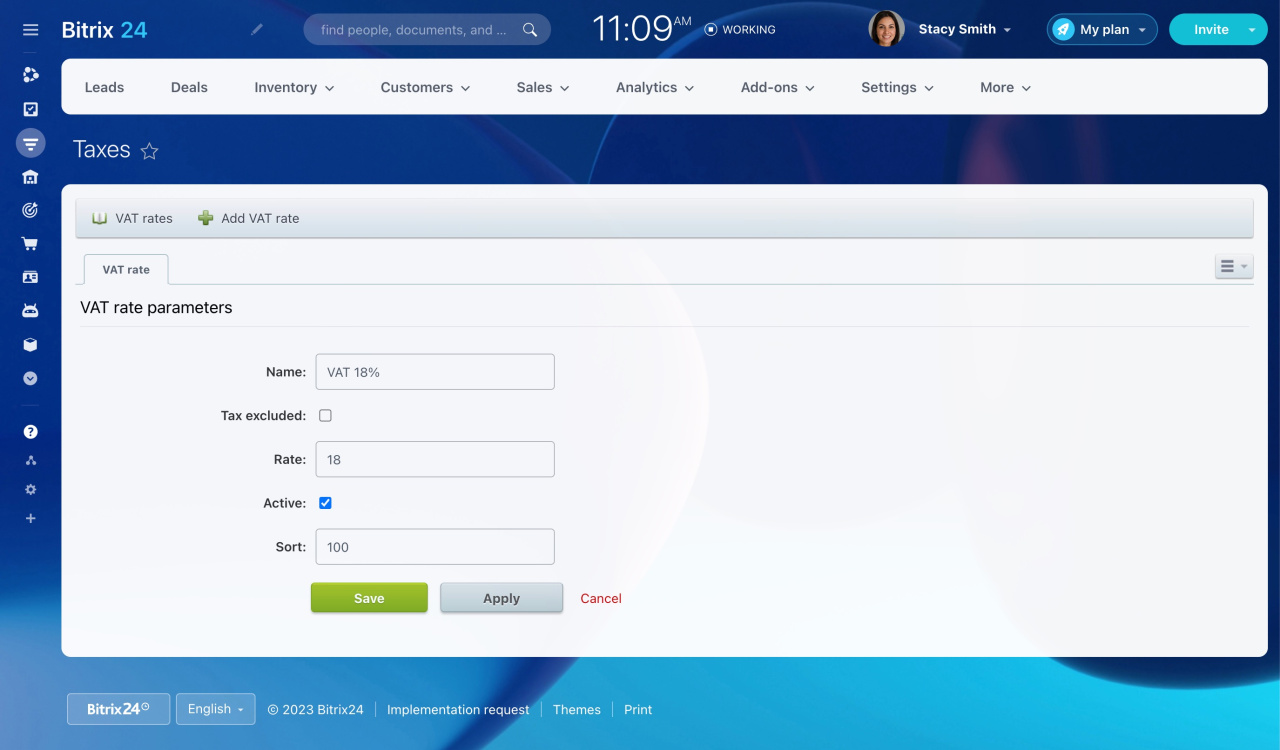

Configure VAT rate parameters.

-

Before you save the settings, ensure to make this tax Active. Then click Save.

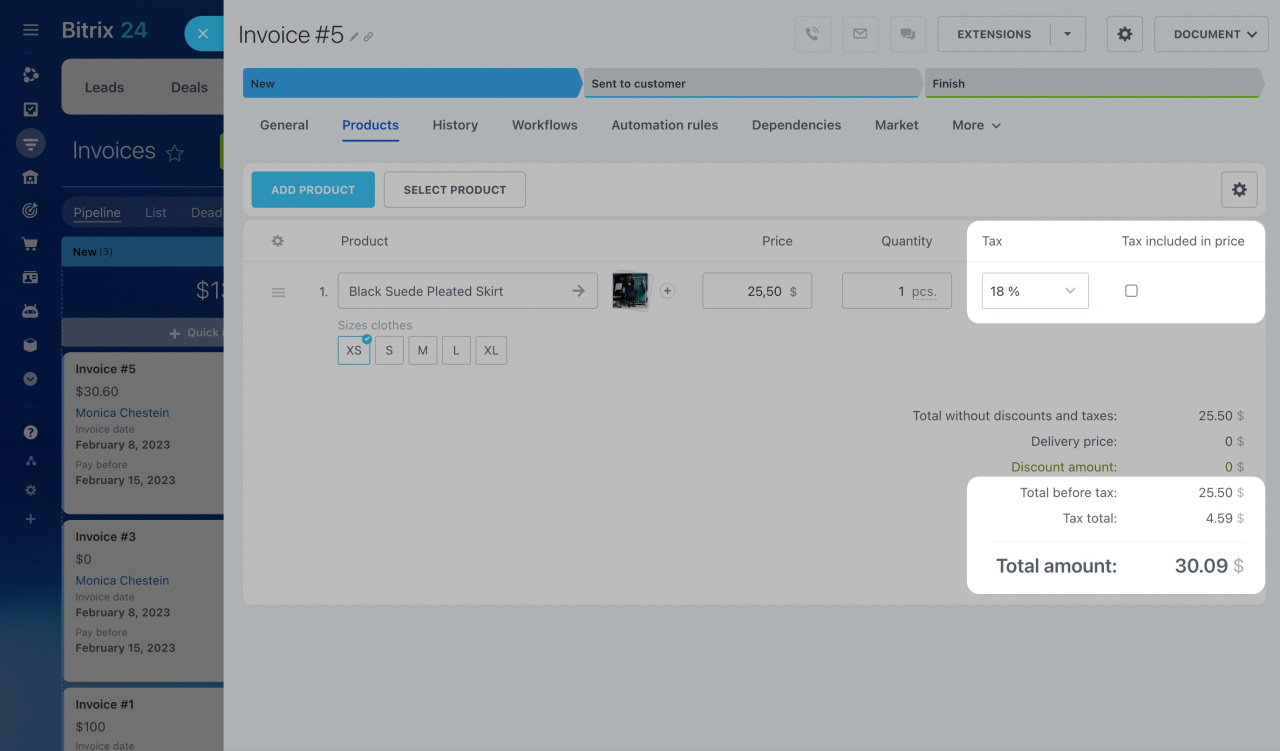

When creating an invoice or estimate, you can choose a VAT rate for each product in the Products tab. Also, you can enable the Tax included in price option.

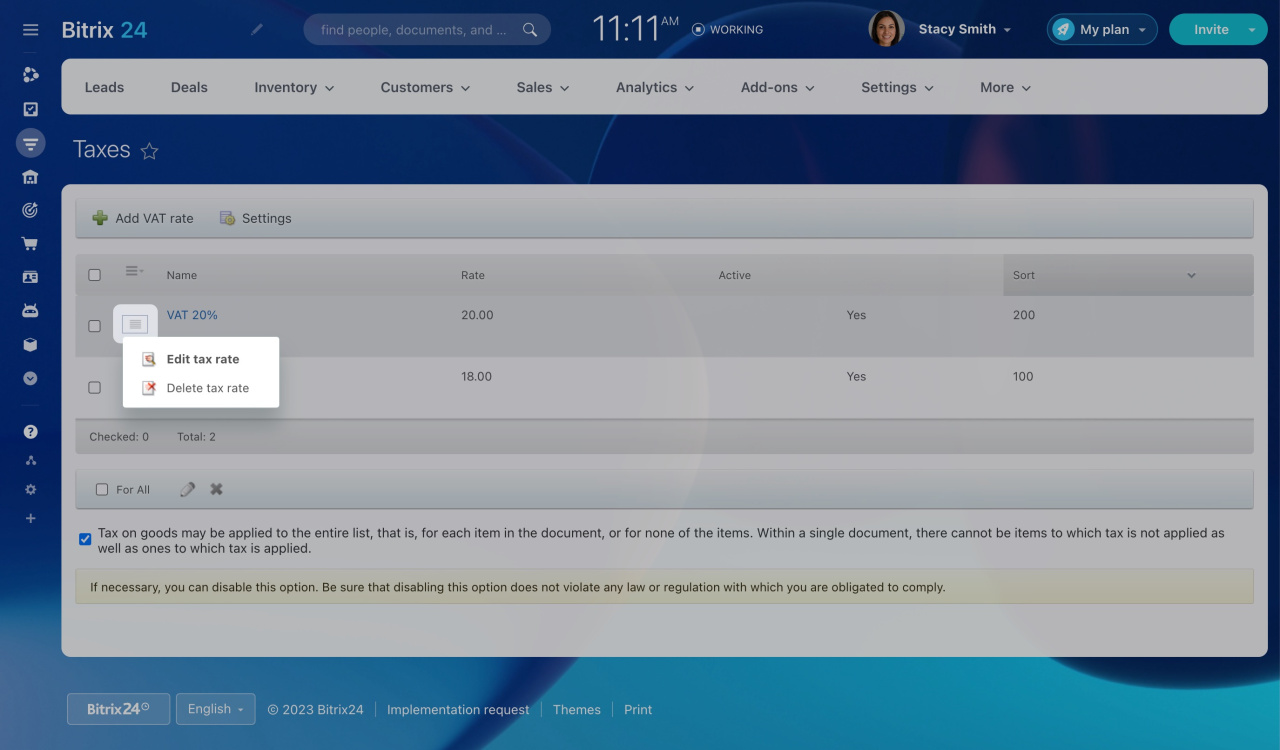

To edit or delete a tax rate, click on the actions button next to its name and select the corresponding action.