If the First In First Out (FIFO) method of costing is selected, products are written off in the order in which they are received in the warehouse. The cost of products sold is based on the price of the balance from the first delivery.

When a product batch runs out, the next write-offs are made at the price of products from the next delivery.

The FIFO method reflects the cost of purchasing products, especially if their price increases over time.

Example of calculating product cost using the FIFO method

An online store sells T-shirts. The first three batches were purchased at different prices. There are a total of 20 T-shirts in the warehouse.

15 T-shirts were sold in the online store. According to the FIFO method, the warehouse will first write off items from the first batch - 10 T-shirts for $100, then from the second batch - 5 items for $60. The total cost of the T-shirts sold will be $1,300.

Only product receipt date matters for the FIFO method. It prevents the goods from lying in stock for a long time and losing their relevance.

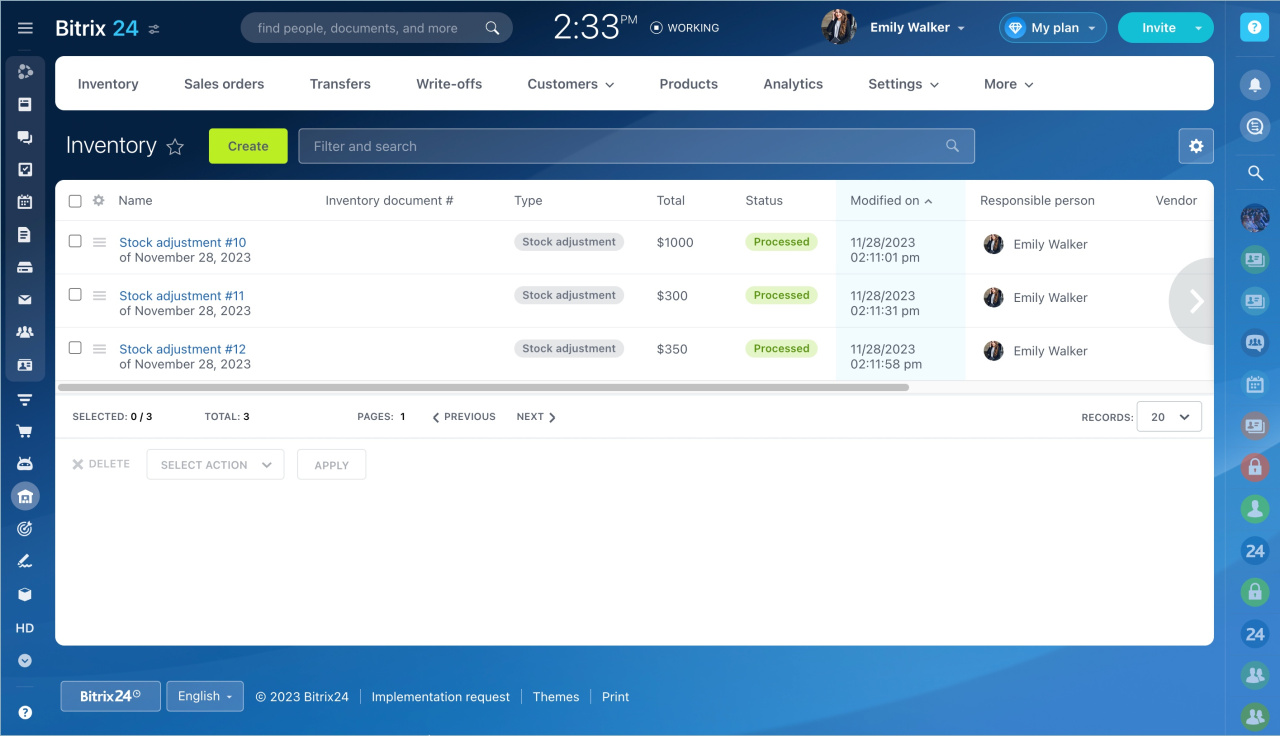

View the results in the gross profit report

Go to the Inventory management section - Analytics tab - Gross profit tab. The report will collect sales information and calculate the figures using the FIFO method. In the report you can see Sales revenue, Cost (total), Gross profit, and Gross margin.

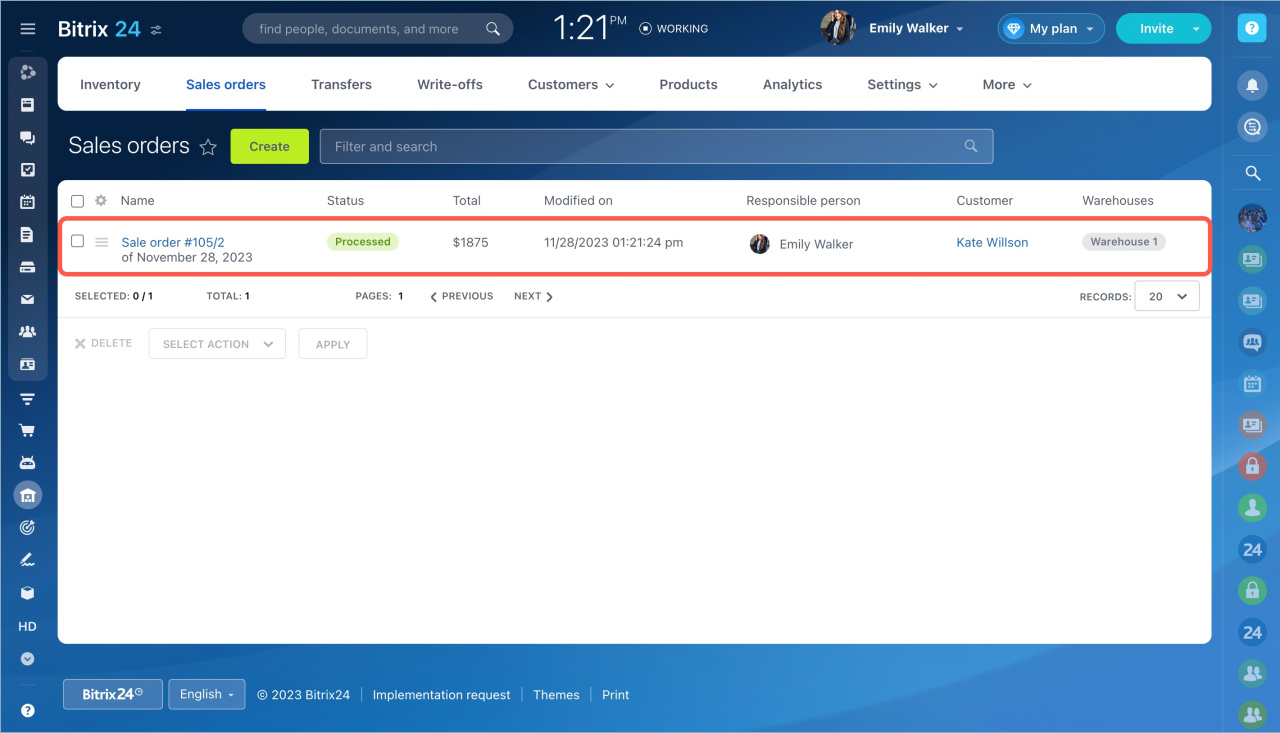

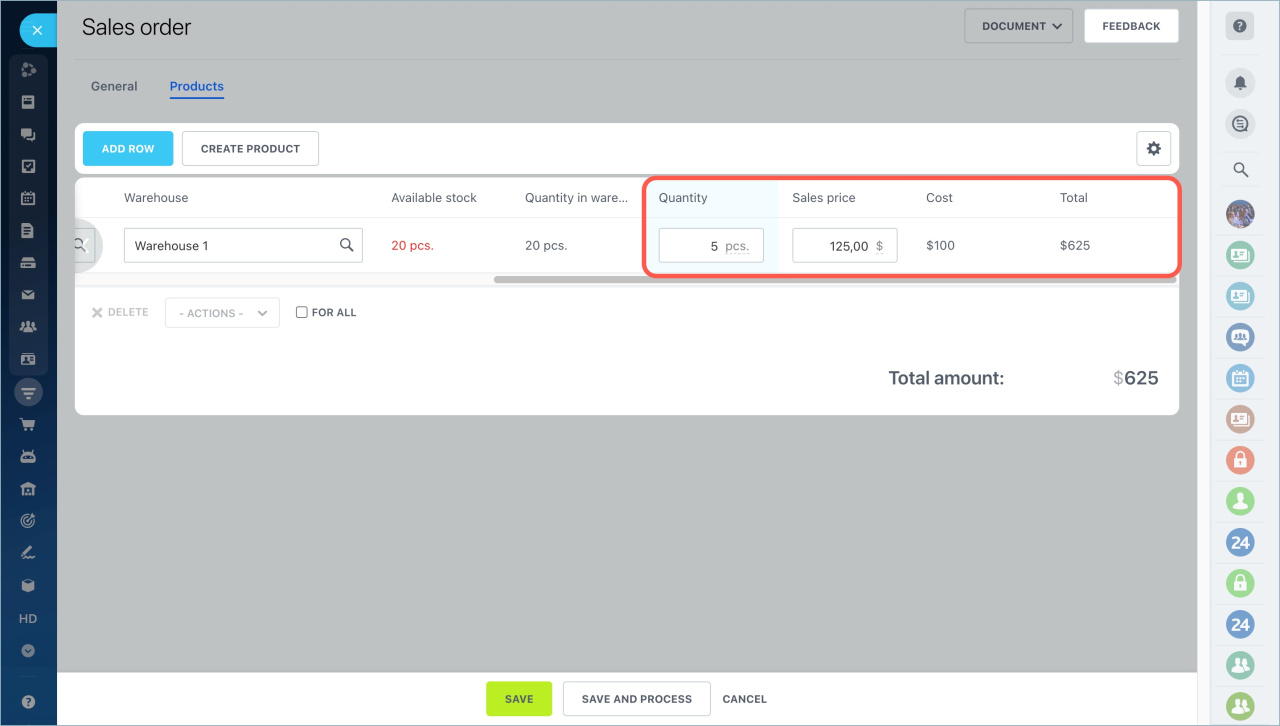

View the product cost in sales order

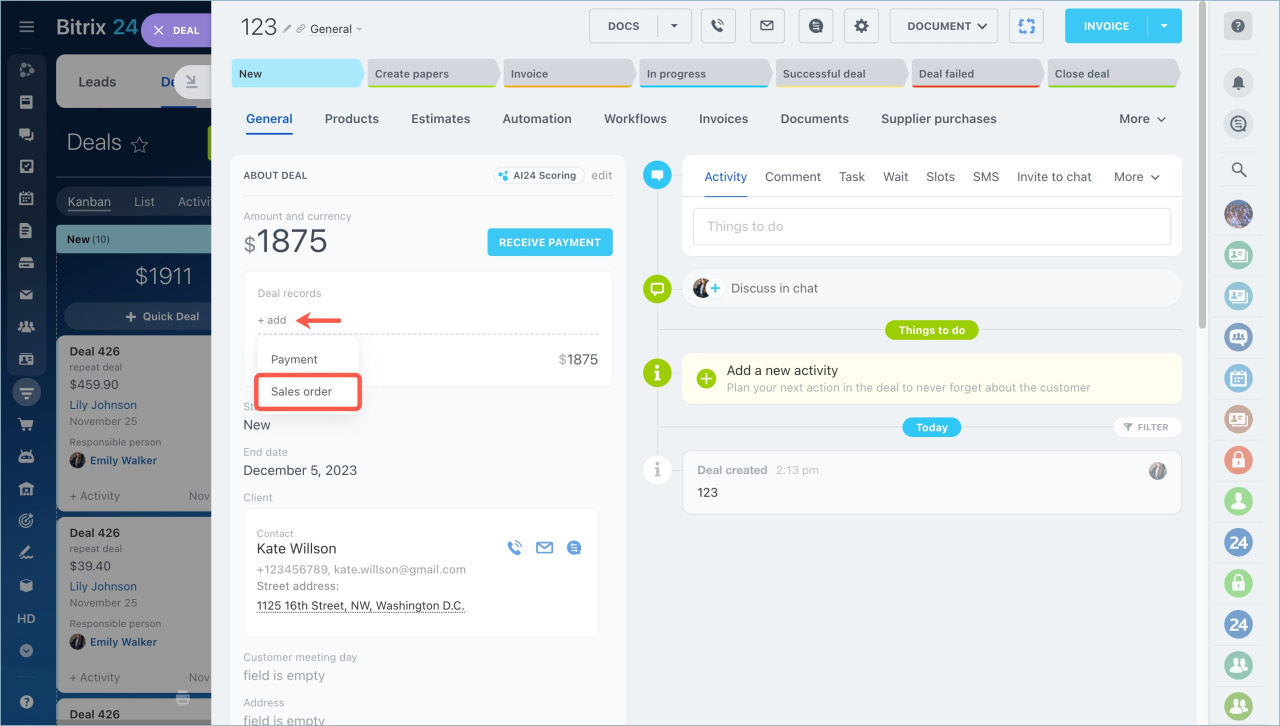

Open the deal form, click Add and select Sales order.

Product cost information help you decide on a discount.

In brief:

- If the First In First Out (FIFO) method of costing is selected, products are written off in the order in which they are received in the warehouse. The cost of products sold is based on the price of the balance from the first delivery.

- Sales revenue, gross profit and gross margin can be viewed in the gross profit report.

- The product cost will help determine the amount of discount on the product.

Read also: