The cost of products is calculated to find out the business profit. In Bitrix24, data on the product cost is immediately included in the gross profit report. You can use it to analyze how much the company earns and adjust prices.

We will tell you about cost calculation methods and the gross profit report in Bitrix24.

Select a costing method

The method of calculating product cost is also called write-offs. Its choice depends on the business peculiarities, goods, tax and accounting policy of the company.

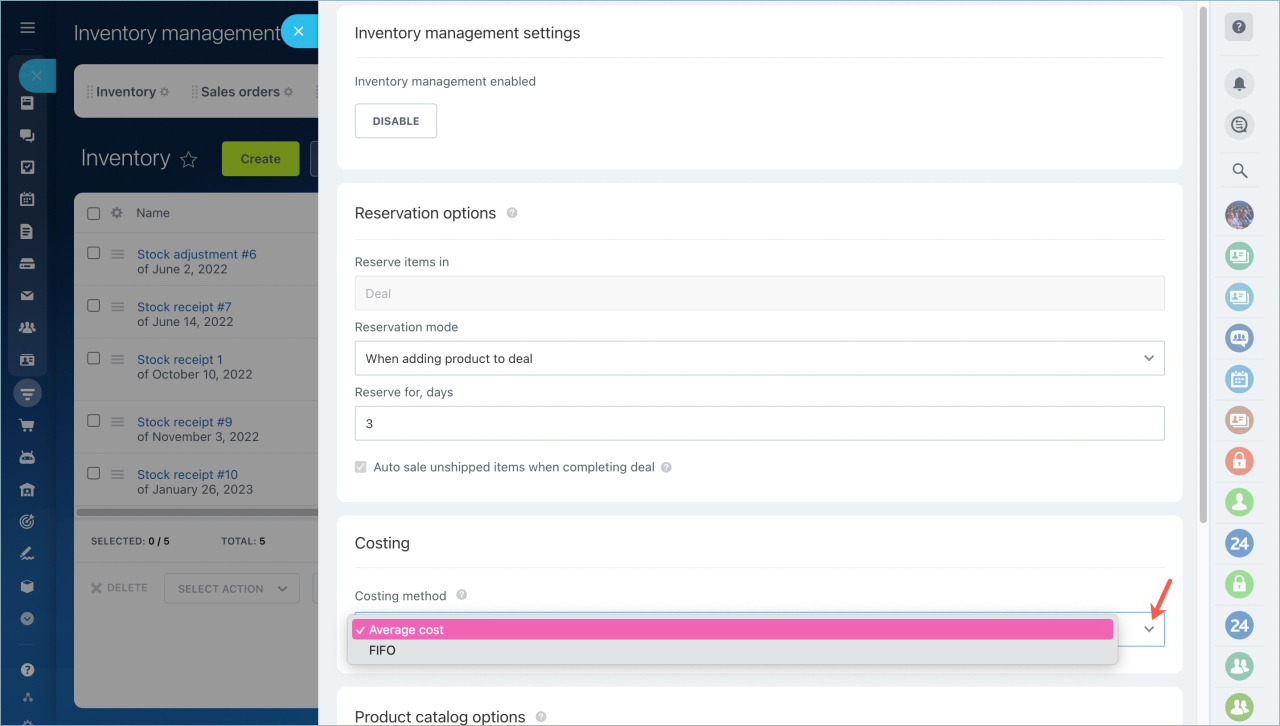

There are two costing methods in Bitrix24:

- First in, first out (FIFO)

- Average cost

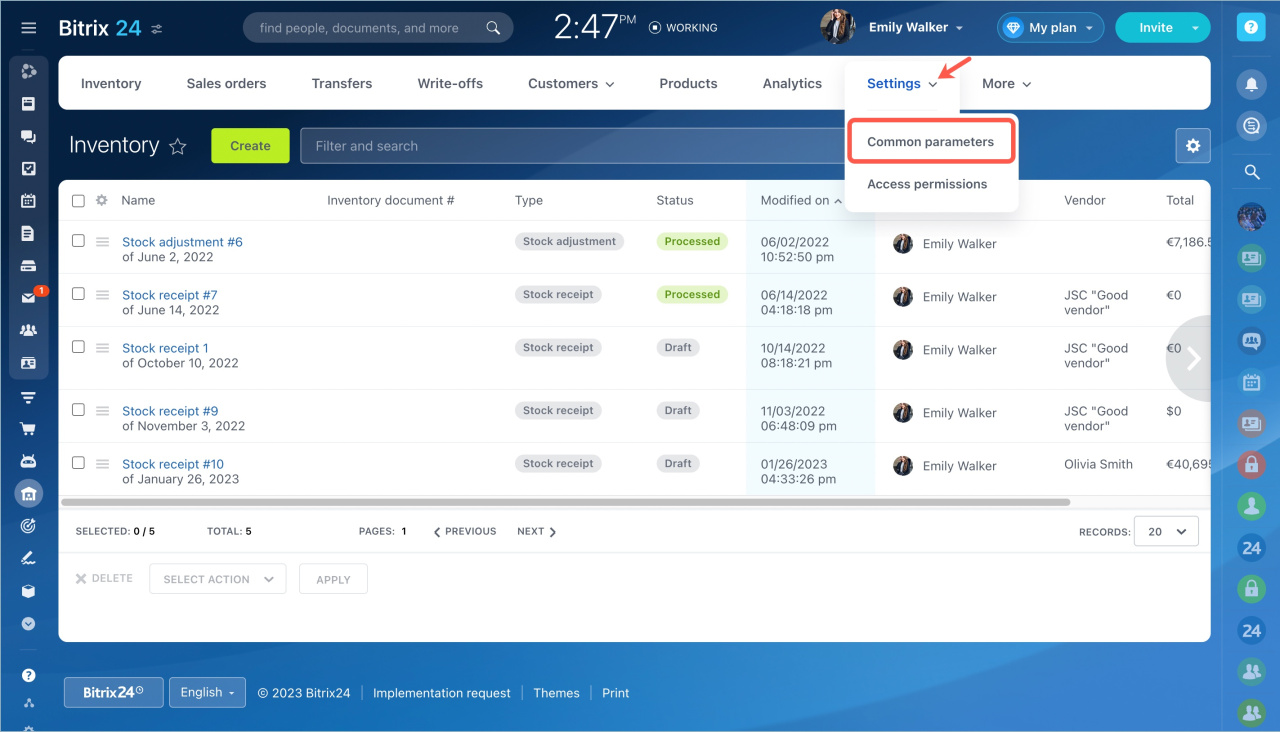

You can select the calculation method in the Inventory management settings. Go to Inventory management section - Settings - Common parameters.

FIFO - a calculation method in which the first goods that arrive at the warehouse must be sold first.

This method reflects the movement of goods and reduces the impact of inflation on costs.

Calculate product cost by FIFO method

Average cost - a calculation method in which the cost of all items in stock is averaged. All items are considered the same no matter when they were purchased and at what price.

This method makes the cost of goods more predictable. It is suitable for business with stable prices, for example, commodities for construction and manufacturing with a long shelf life.

Calculate product cost by average cost method

Monitor profit indicators in report

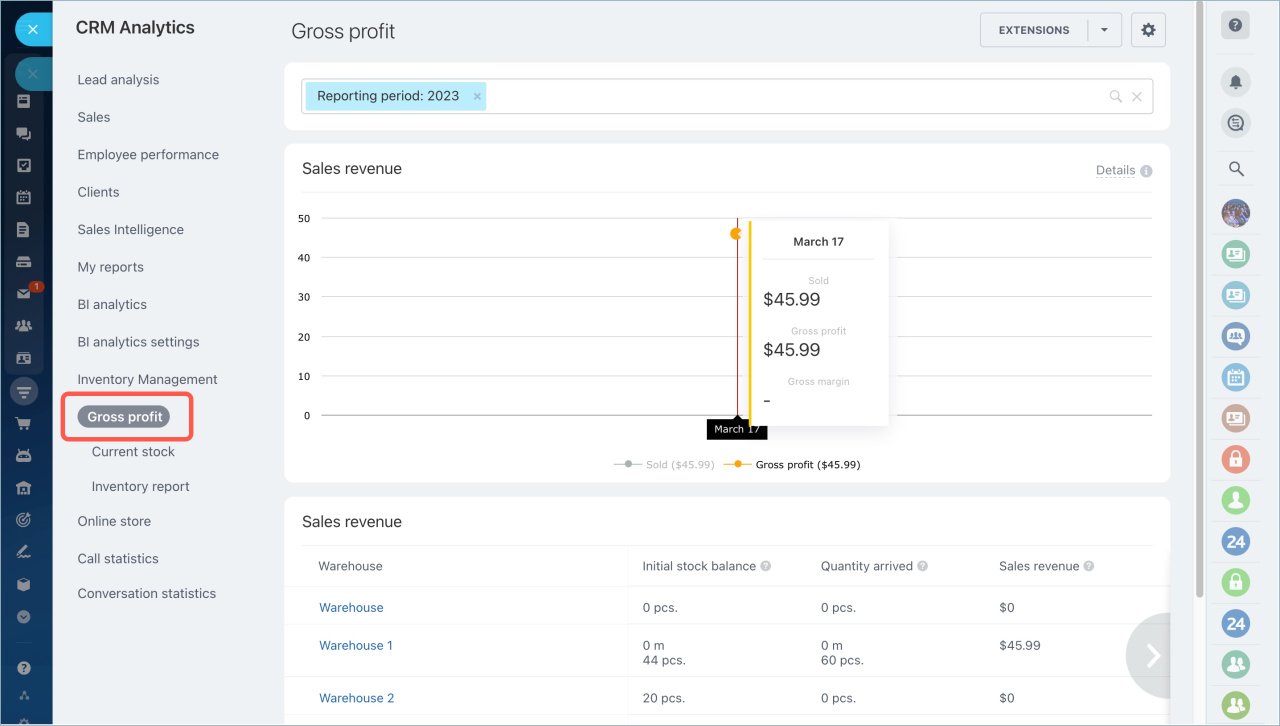

When you select a costing method, you will be able to monitor gross profit in the report. To view the report, go to the Inventory management - Analytics - Gross profit.

The gross profit report reflects the difference between the income from sales and the cost of buying the goods sold. Look at gross profit: the higher it is, the better it is for the business.

Profitability is the percentage of gross profit as a percentage of total revenue. A high percentage indicates that the company is managing costs effectively and making a good profit. You can determine whether you should adjust prices or choose other suppliers.

Gross profit report

Impact of canceling warehouse documents on the report indicators

Employees keep stock records and sometimes make mistakes: they may move a product to another warehouse or account for an extra item. In Bitrix24, the corrected inaccuracy will not affect the report indicators.

For example, the employee accounted for 20 extra monitors and increased the stock balance to 100 pieces by mistake. After canceling the stock receipt document, the number of monitors in stock is 80. The previous documents will remain unchanged, only the current balance will be adjusted.

If you cancel a document after the goods have been received, make sure that there are enough goods in stock. Otherwise, you will not be able to cancel the document.

In brief:

- Select the costing method in the Inventory management to monitor the gross profit.

- There are two costing methods in Bitrix24: by average cost and by First in, first out (FIFO).

- A gross profit report will show you the difference between sales revenue and the cost of goods sold. It will help you keep track of your performance so that you can make decisions to raise prices or change suppliers.

- If you cancel a document after the goods have been processed, make sure that there are enough goods in the warehouse. Otherwise, you will not be able to cancel the document.

Read also: